A Constrained CRE Lending Market Signals Little Trouble on the Horizon for Commercial Real Estate Returns

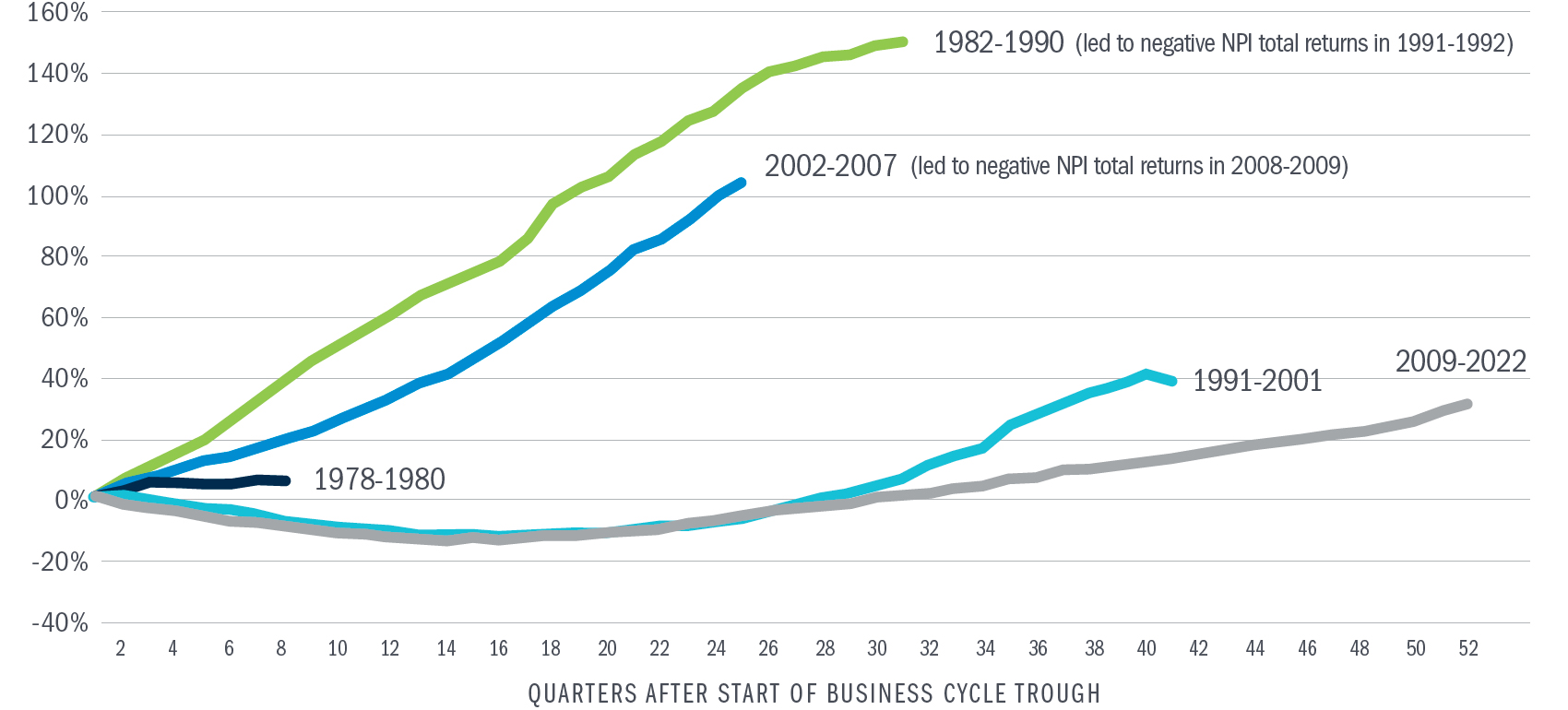

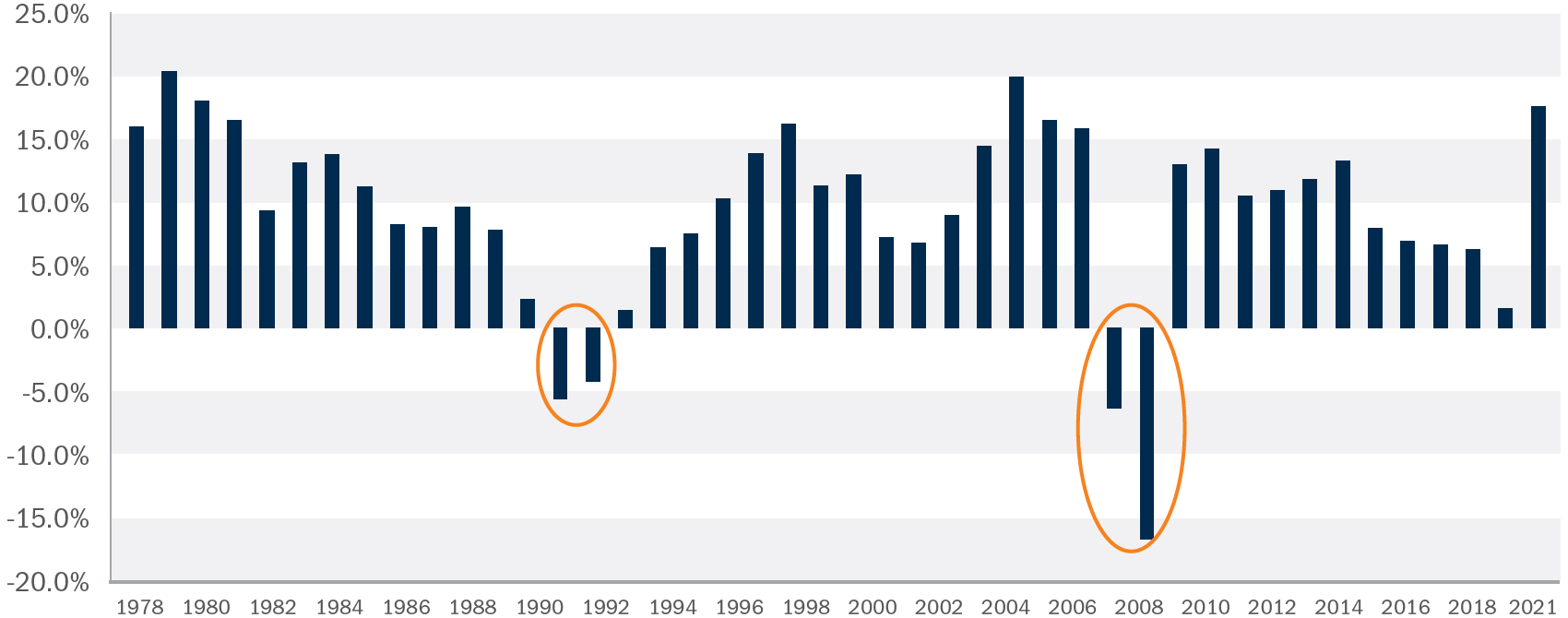

The current real estate market can be distinguished from other real estate recovery periods due to constrained mortgage growth, a key indicator of future returns. Over the 44-year history of the institutional private real estate index, real estate returns have been negative in only two periods, both of which were preceded by the highest historical growth in mortgage debt and therefore, many have considered those two periods to be “real estate-led/related recessions”.

Cumulative Growth in Commercial Mortgage Debt from Trough of Prior Business Cycle

NPI Total Annual Returns

01/01/1978 – 12/31/2021

Sources: Bluerock analysis of Federal Reserve Z.1, Flow of Funds. National Council of Real Estate Investment Fiduciaries. Provided for informational purposes only. No assurance is given that market conditions and related trends will continue.

This information is educational in nature and does not constitute a financial promotion, investment advice or an inducement or incitement to participate in any product, offering or investment. Bluerock is not adopting, making a recommendation for or endorsing any investment strategy or particular security. All opinions are subject to change without notice, and you should always obtain current information and perform due diligence before participating in any investment. All investing is subject to risk, including the possible loss of principal. Bluerock cannot guarantee that the information herein is accurate, complete or timely. Past Performance does not guarantee future results.