At a Fraction of the Cost of Transportation, Industrial Real Estate Rents Still Seem Like a Bargain

Market participants have observed and speculated about the industrial real estate sector’s record-breaking rise in rents and absorption and impressive total returns of the last few years, and questioned whether the trend has ended. But, that engine isn’t stalling, it’s just revving up. The current performance of industrial real estate is not so much linked to a broader economic cycle or to the manufacturing sector like it once may have but, more connected to the explosion of online retail, or e-commerce. This growing online trend has revolutionized the industrial sector and its projected path points toward much greater industrial real estate demand. When thinking about industrial real estate in today’s world, think Amazon, not U.S. Steel.

“Transportation costs range from approximately 50-70% of a company’s total logistics costs while fixed facility costs including real estate range from 3-6%.”

Why do we believe the sector has a lot of runway?1

According to CBRE’s Supply Chain Advisory Group, “it takes roughly an 8 percent increase in fixed facility costs to equate a 1 percent increase in transportation costs”. A company’s industrial real estate lease cost is really an investment that currently generates a very attractive return. CBRE’s Supply Chain Group also notes that transportation costs range from approximately 50-70% of a company’s total logistics costs while fixed facility costs including real estate range from 3-6%. Companies are expanding their real estate footprints to reduce much higher shipping costs. As one industry participant put it “commercial real estate costs are just a rounding error”. Securing more real estate, even at higher rents, is still good business.

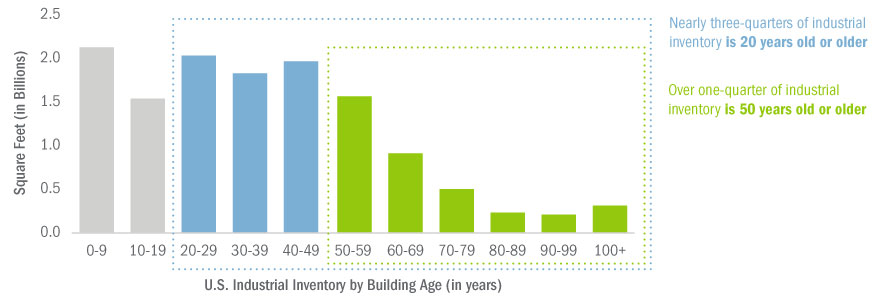

A Strong Market with Aging Inventory

In addition to these cost tradeoffs, the current national industrial market is over 96% occupied and e-commerce as a percent of total retail sales is projected to more than double in the next 20 years. On the supply side, total cost to build a warehouse is up 21%, all while 25% of the nation’s industrial real estate inventory is over 50 years old and may begin to suffer from obsolescence.

Industrial Real Estate Inventory by Age

Source: JLL Research

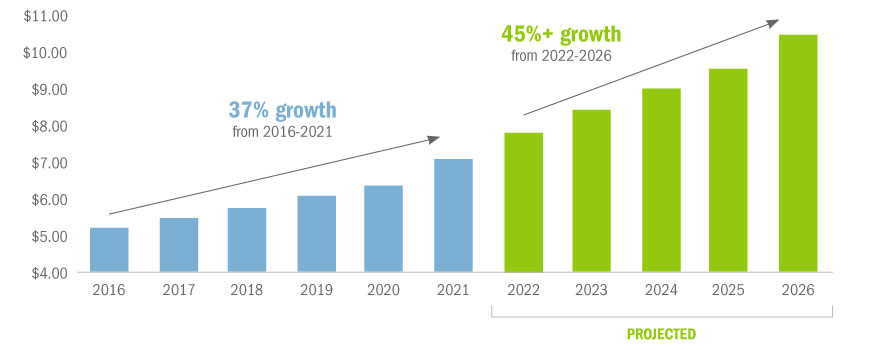

Strong Occupancy and High Demand Drive Rent Growth2,3

The industrial space crunch may not subside any time soon. New research from JLL is projecting 8% rent growth by year-end 2022 and suggests that the growth may accelerate. Other forecasts (Green Street) call for 9% annual revenue growth through 2025. This new research also suggests that the “imbalance of supply and demand will continue through 2023 and further exacerbate the race for space”. Construction timelines that were once 9 months are now taking up to 2 years.

“It takes roughly an 8 percent increase in fixed facility costs to equate a 1 percent increase in transportation costs.”

Average Asking Annual Rent (per square foot)

Source: JLL Research | Green Street U.S. Industrial Outlook, January 2022

Capital markets have taken notice. Industrial cap rates have compressed and public industrial REITs have traded at premiums in the first quarter of 2022 to net asset values. As inflation persists, fixed income investing is challenged, equity markets struggle, and few attractive options exist given that retail and office sectors lack the demand drivers of industrial. As a result, we expect more capital to flow into the sector further supporting values and above overall market returns.

1 Globest.com, Sept 2021 (https://www.globest.com/2021/09/22/how-transports-rule-of-1-5-is-driving-soaring-demand-for-warehouse-space/)

2 JLL, The Race for Space, 2022

3 Green Street, U.S. Industrial Outlook, January 2022

This information is educational in nature and does not constitute a financial promotion, investment advice or an inducement or incitement to participate in any product, offering or investment. Bluerock is not adopting, making a recommendation for or endorsing any investment strategy or particular security. All opinions are subject to change without notice, and you should always obtain current information and perform due diligence before participating in any investment. All investing is subject to risk, including the possible loss of principal. Bluerock cannot guarantee that the information herein is accurate, complete or timely. Past Performance does not guarantee future results.