Underlying Fund Portfolio Highlights

$27.2B

Billion Underlying Loan Value

1,550+

Unique Issuers

1,660+

Number of Loans

99.7%

Senior Secured Loans

98.5%

Floating Rate

$97.94

Avg. Loan Price

Fund AUM: $108+ Million (As of 12.31.23)

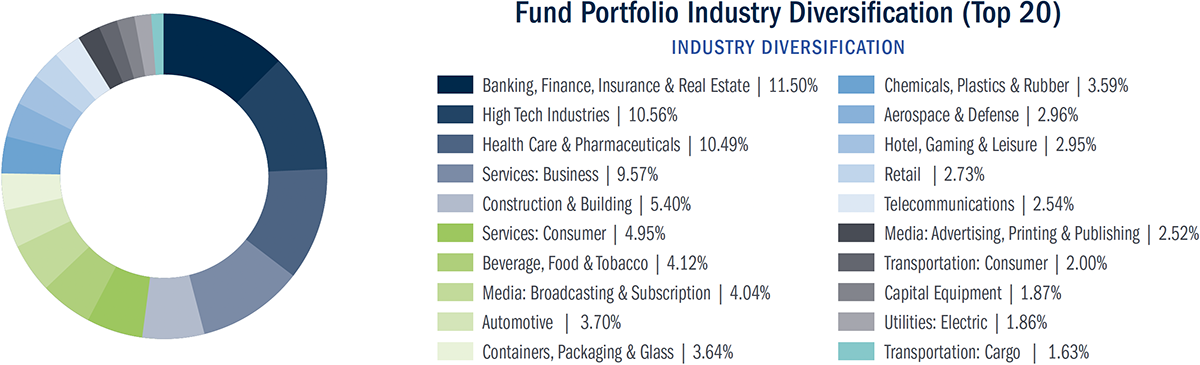

Fund Portfolio Industry Diversification (Top 20)

Industry Diversification

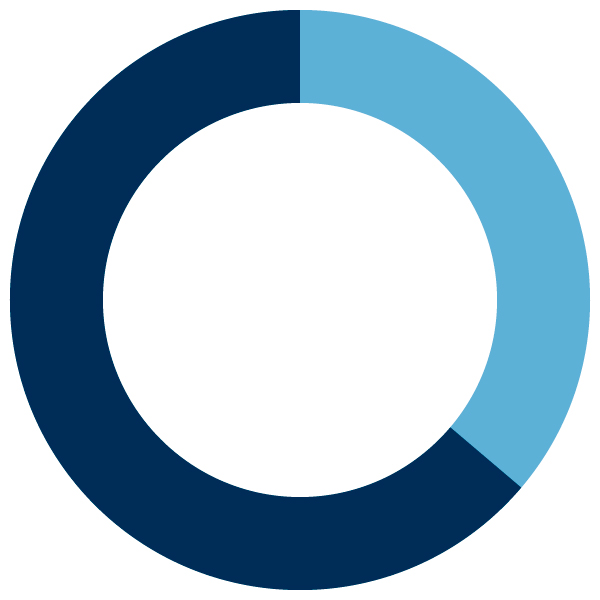

Asset Allocation

65.4%

Equity

34.6%

Debt

Credit Allocation (Top 10)

| Moody's Industry Classification | Issuer Name | % Exposure |

|---|---|---|

| High Tech Industries | Quest Software | 0.90% |

| Services: Business | Cornerstone OnDemand | 0.63% |

| Containers, Packaging & Glass | Intertape Polymer Group | 0.60% |

| Construction & Building | Park River Holdings | 0.55% |

| High Tech Industries | Vision Solutions | 0.54% |

| Retail | Bass Pro Shops | 0.52% |

| High Tech Industries | Kofax | 0.49% |

| High Tech Industries | Mandolin Technology | 0.48% |

| Beverage, Food & Tobacco | Restaurant Brands | 0.46% |

| Containers, Packaging & Glass | Pretium PKG Holdings | 0.46% |

Underlying portfolio subject to change at any time and should not be considered investment advice. Underlying data as of December 2023. Diversification does not ensure profits.