The Fund seeks to generate high current income while secondarily seeking attractive, long-term risk-adjusted returns with low correlation to the broader markets.

11.0% Current Annualized

Distribution Rate*

Paid Quarterly

Portfolio Placement

• Income Generation

• Portfolio Diversifier

Distinguishing Characteristics

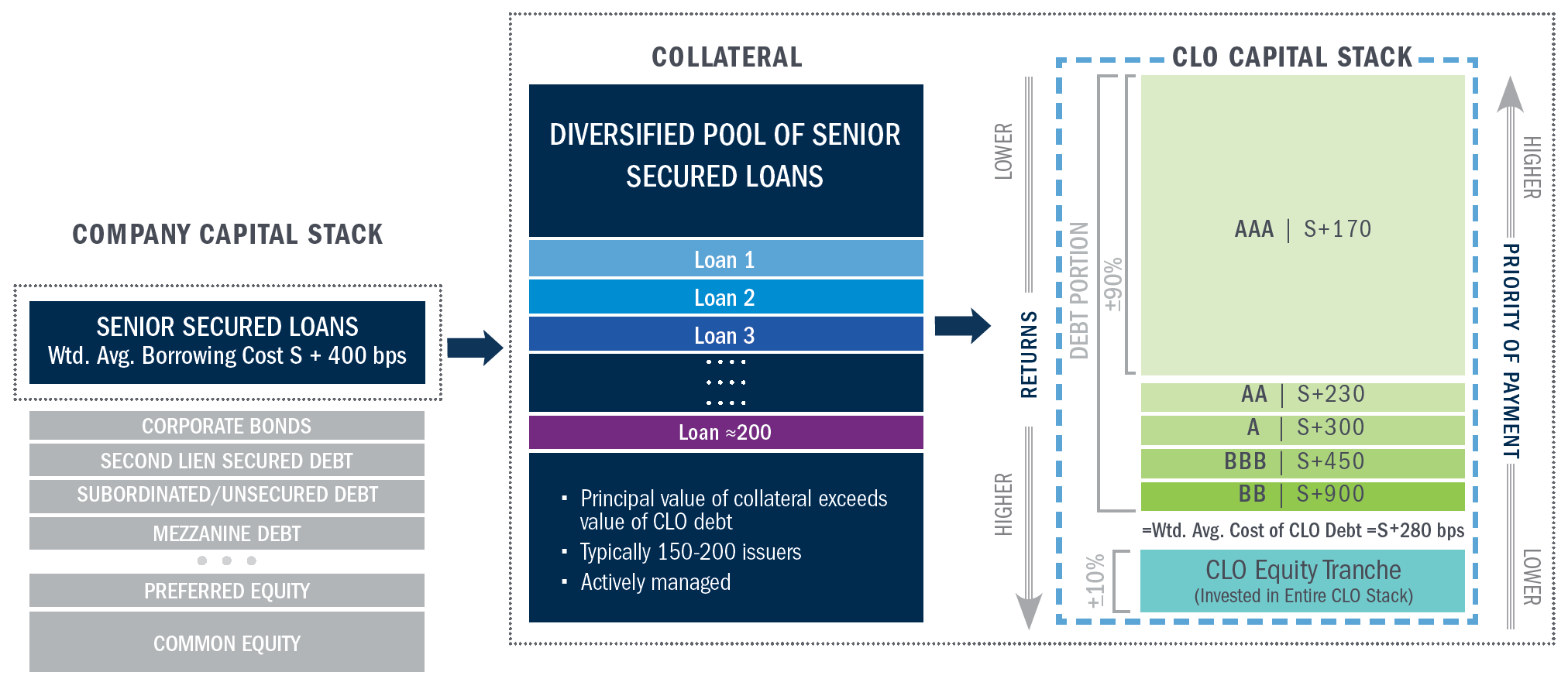

Income-focused portfolio allocation by investing, directly or indirectly, in senior secured loans and entities that own a diversified pool of senior secured loans known as Collateralized Loan Obligations (“CLOs”).

The Fund aims to provide investors with:

- 11.0% annual distribution rate in an interval fund format, distributed quarterly

- Exposure to loans with highest payment priority and secured by corporate assets

- Significantly reduced exposure to rising interest rate risk

- Diversification potential to broader markets

Attractive Features of Senior Secured Loans

Multiple market cycle-tested, resilient asset class with low historical impairment rates

Senior

Single highest and most senior position in a company’s capital structure

Secured

First lien security interest in a company’s assets, including cash, receivables, inventory, property, plant and equipment (PP&E) and all other assets

Floating Rate

Helps mitigates against rising interest rate risk associated with fixed rate bonds

Potential Benefits of Accessing Senior Secured Loans through CLOs

Managers can gain exposure to Senior Secured Loans through the strategic investment in CLOs. CLOs are actively managed vehicles where the structure provides opportunities to accretively reinvest cash flows and benefit from volatility in the loan market.

Attractive Distribution Rates

CLO Equity has delivered approximately 15% average annualized distributions over the last two decades1

Diversified Loan Pool

Actively managed, diversified pools of senior secured loans issued to large, mature companies across multiple industries

Substantial

Structured Guardrails

Mandated guidelines for investor protection across the entire loan obligation

Performance Thru

Economic Cycle

Active investment management with ability to trade away from riskier loans or add loans trading at a discount contributes to attractive performance across the economic cycle

Lower Interest Rate Risk

Floating interest rates on underlying loans, coupled with minimum interest rate floors, may diminish the negative impact of rising interest rates

Attractive Structure

Low cost, long-term, non-recourse financing, with no forced selling of loans by CLO Manager

The CLO Structure

The CLO structure has multiple on-going, built-in safeguards, self-correction mechanisms, and required collateral quality tests which seeks to optimize risk-adjusted returns.2

Accessing Senior Secured Loans through Collateralized Loan Obligations (CLOs)

CLOs are a diversified pool of 150-200 senior secured loans, comprehensively underwritten and constructed by leading institutional investment managers with robust credit expertise.

Credit ratings are provided by third party credit agencies, including S&P, Fitch and Moody’s, and indicate forward looking opinions about an issuer’s relative creditworthiness. A typical rating scale may include AAA, AA, A, BBB, BB, with below BBB- (or Baa3) typically denoting below investment grade.

S = The Secured Overnight Financing Rate (SOFR) is a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities.

1 CLO Equity (or CLO equity tranche): The tranche within a CLO that is paid any excess spread. The equity tranche payment is prioritized after all the debt and subordinated tranches. Source: Kanerai, Intex, Markit, Barclays Research, includes CLO 1.0 and 2.0 broadly syndicated loans. Yields do not include return of principal. Represents period from 2003-2022 with average annualized yields of 14.8%, as of 6.30.2023. Does not represent total return experienced by investor. Past performance is not a guaranty of future performance.

2 CLOs are subject to mandatory on-going required testing including, but not limited to, collateral concentration limitations, interest coverage tests to ensure cash flows exceed debt tranche payments by predetermined amounts, diversification requirements on issuers, industry, and credit, and collateral quality tests which requires principal value of a CLO’s underlying loan pool to exceed the value of CLO debt, that together, are intended to place additional mechanisms and restrictions on how CLOs are managed.

* The Fund accrues distributions daily. The current annualized distribution rate is calculated by annualizing the daily accrual rate of the Fund as of October 1, 2023. The Fund’s distribution policy is to make quarterly distributions to its shareholders, but the amount of such distributions is not fixed. There is no assurance that the Fund will continue to declare distributions or that they will continue at the current rate. All or a portion of the distributions may consist of a return of capital based on the character of the distributions received from the underlying holdings, primarily CLO junior debt and equity tranches. Shareholders should not assume that the source of a distribution from the Fund is net profit. The final determination of the source and tax characteristics of all distributions will be made after the end of the year. Shareholders should note that return of capital will reduce the tax basis of their shares and potentially increase the taxable gain, if any, upon disposition of their shares.

** The Fund is a closed-end interval fund, the shares have no history of public trading, nor is it intended that the shares will be listed on a public exchange at this time. No secondary market is expected to develop for the Fund’s shares. Limited liquidity is provided to shareholders only through the Fund’s quarterly repurchase offers for no less than 5% of the Fund’s shares outstanding at net asset value and there is no guarantee that an investor will be able to sell all the shares that the investor desires to sell in the repurchase offer. The Fund is suitable only for investors who can bear the risks associated with the limited liquidity of the Fund and should be viewed as a long-term investment.