Bluerock’s Q1 2022 Market Insights Newsletter

In This Issue…

- What the Fed Rate Hike Means for Real Estate Investors

- Housing Inflation is Going Nowhere But Up

- For Industrial Property, The Problem Isn’t Demand. It’s Supply.

- This is Now the Worst Drawdown on Record for Global Fixed Income

- Surging E-Commerce will Spur Industrial Rents to Grow 15%

- New Data – Fundamentals: Net Operating Income

- Research Report – Cushman & Wakefield Industrial Marketbeat Q4 2021

FEATURED CONTENT

What the Fed Rate Hike Means for Real Estate Investors

Will the Fed rate hikes splash cold water on the real estate bull market? Not likely. Investor surveys indicate the 10-year Treasury yield would have to spike 150 basis points or more pushing the 10-year Treasury yield to 3.4% or higher before a significant amount of investors would pull back their real estate investment activity. Since the long end of the yield curve is not as heavily influenced as the short end by Fed actions, it’s hard to imagine this key rate this high in the near future.

Source: Marcus and Millichap

IN THE NEWS

Housing Inflation is Going Nowhere But Up

With vacancy rates at the lowest level in a generation and for sale prices skyrocketing, it’s no surprise Corelogic chief economist claims “rents will go up”.

Source: Yahoo Finance

For Industrial Property, The Problem Isn’t Demand. It’s Supply

If there were ever a quote that summed up a tight market, this is it from the head of the nation’s largest industrial REIT. ‘People Simply Can’t Get the Space They Need,’ Prologis Chief Says.

Source: Costar

This is Now the Worst Drawdown on Record for Global Fixed Income

Fixed income investing is not a pleasant allocation in a rising rate environment. Investment grade bond drawdowns have become significant and the near future is not looking bright. Advisors will likely seek alternatives.

Source: Bloomberg

Surging E-Commerce Will Spur Industrial Rents to Grow 15%

It turns out that spending higher and higher rents on real estate saves companies’ money because it can reduce the much larger transportation costs that account for 65% of logistics costs. That and more e-commerce should boost rents 15% over the next two years.

Source: Globe St.

NEW DATA

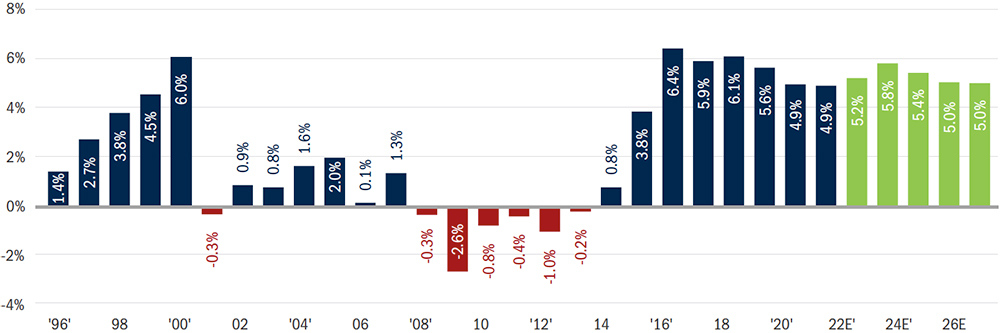

Fundamentals: Net Operating Income

Industrial NOI Growth Estimates*

* Top 50 markets. Not representative of REIT reported results.

Source: Green Street. U.S. Industrial Outlook, January 2022

RESEARCH REPORT

Cushman & Wakefield Industrial Marketbeat / Q4 2021

The U.S. industrial market ended the year with record-setting demand, outpacing

supply for the fourth quarter in a row

The U.S. industrial vacancy rate fell to 3.7% in 2021—an all-time record low. The vacancy rate is now 220 bps below the 10-year historical average of 5.9%.

Read Full ReportAggressive competition for space further pressured rents in Q4 2021, increasing 9.5% YoY to $7.39 per square foot (psf).

QUOTES OF THE QUARTER

As consumers become more accustomed to purchasing online, their expectations with regards to delivery service and speed mount,” Transportation costs account for nearly 65% of total logistics costs, making it the focus of any strategy aiming to reduce supply chain costs. Inefficiencies converge around transportation, especially in dense urban areas. For e-commerce occupiers, reducing the delivery distance to 30 minutes or less is critical.

CAROLYN SALZER AND JASON PRICE

Cushman & Wakefield

I’ve never seen anything like this in 40 years of doing this in our development portfolio, people simply can’t get the space they need, and it will be several years until supply outpaces demand.

HAMID MOGHADAM

CEO of Prologis, the world’s largest owner and developer of industrial space

We do not see any clouds on the horizon. There’s a significant backlog of demand from tenants.

BLAINE HECK

A Wells Fargo analyst who tracks office and industrial real estate investment trusts

Read more insights on the Bluerock Library.