Bluerock’s Q1 2023 Market Insights Newsletter

In This Issue…

- Private Assets Like CRE Can Create a “New” 60-40 Model for Portfolios

- Real Estate Investors Brace for a Liquidity Squeeze Amid Bank Sector Turmoil

- Investors Eye Industrial Assets with Shorter Walts as Capital Costs Rise

- Looming Multifamily Oversupply Likely Will Be Short-Lived

- Green Street Still Expects a Soft Landing for CRE

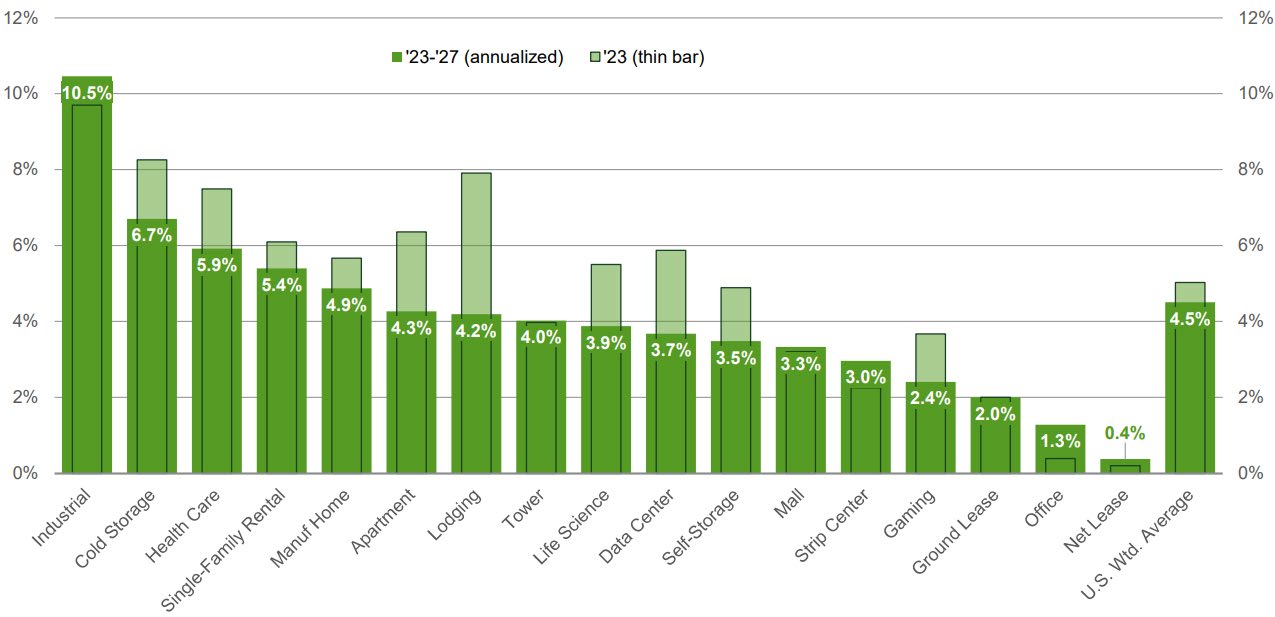

- New Data – The Industrial and Single-Family Rental Sectors are Among the Leaders in Projected NOI Growth for the Next Five Years

- Research Report – Industrial Tenant Demand Study 2023

FEATURED CONTENT

Private Assets Like CRE Can Create a “New” 60-40 Model for Portfolios

2022 was one of the worst years ever for the 60/40 stock/bond portfolio. University endowments largely avoided the significant declines due to positive returns on private assets like real estate, private equity, and natural resources.

Source: Wealth Management

IN THE NEWS

Real Estate Investors Brace for a Liquidity Squeeze Amid Bank Sector Turmoil

Concerns are high, but conditions don’t appear to be flashing a full-fledged banking crisis. The commercial real estate market should expect tougher lending conditions and stricter underwriting, but probably not a debt market shutdown.

Source: Wealth Management

Investors Eye Industrial Assets with Shorter Walts as Capital Costs Rise

Why are shorter remaining lease terms valuable for industrial properties? “Consider a six-year lease signed in 2016 with 2.5% annual escalations: on average, according to Newmark, rents on that lease would be 36% below market rent today.

Source: Globest

Looming Multifamily Oversupply Likely Will Be Short-Lived

The above-trend supply of new construction is likely to be limited to 2023 and it won’t be enough to fully mute rent growth with CBRE still projecting 3.5% annual rent growth this year.

Source: CBRE

Green Street Still Expects A Soft Landing for CRE

Greenstreet sees some additional price declines in select sectors in addition to the estimated 15% decline since March 2022 peak pricing. But, they believe the U.S. has felt most of the pricing pain and values appear to be near the bottom.

Source: Globest

NEW DATA

The Industrial and Single-Family Rental Sectors are Among the Leaders in Projected NOI Growth for the Next Five Years

Source: Green Street

RESEARCH REPORT

Jones Lang LaSalle | Industrial Tenant Demand Study 2023

While e-commerce demand has normalized, it continues to drive demand requirements for the Logistics and Parcel Delivery industry. This year the Logistics and Parcel Delivery industry remained in the number one spot, with over 194 m.s.f. in requirements.

Read Full ReportLand-constrained port markets will continue to endure severe supply limitations. Due to severe supply constraints, we anticipate there will be less transactions in port-heavy markets with extremely low vacancies. This does not indicate a slowdown in inquiries but rather that there has been a lack of solutions for expanding pent-up demand in and across many markets. While the overall under-construction pipeline is at an all-time-record peak, high interest rates are knocking out developers requiring financing, which could result in a slowdown in construction activity.

Subscription may be required.

QUOTES OF THE QUARTER

Our house view is that there is certainly a more constrained credit market, at least temporarily

MICHAEL RICCIO

Senior Managing Director and Co-Head of National Production, CBRE Capital Markets

Industrial rent growth is not expected to slow as much as previously forecast; NOI growth revised higher as a result, Life science and data center also revised up. Single-family rental NOI for next year is lower, but the long-term outlook is just fine.

GREEN STREET US COMMERCIAL PROPERTY OUTLOOK

Read more insights on the Bluerock Library.