Contrasting CLOs to CDOs and CMBS

Similar acronyms, very different vehicles

CLOs are highly differentiated from other structured credit products.

Figure 1 – Contains a summary of the main differences between CLOs and CDOs and CMBS.

| CLO | CDO | CMBS | |

| Name | Collateralized Loan Obligation | Collateralized Debt Obligation | Commercial Mortgage- Backed Securities |

| Collateral | Senior secured corporate loans | Asset-backed security tranches such as residential mortgages | First lien mortgages on commercial real estate |

| Management | Active management | Static securitization | Static securitization |

| Interest Rate Exposure | Typically floating rate, reset 3-6 months (typically LIBOR/SOFR) | Both fixed and floating rate | Typically fixed rate |

| Diversification | Typically 150-300 issuers, diversified by industry, issuer, credit rating, and others | Correlated underlying mortgages typically from the same mortgage originator and servicer | 30-70 loans, "top-heavy;" ten largest loans typically account for ~50% of collateral balance |

| Collateral Quality Tests | Spread/coupon, rating, recovery rate, diversity, average life | Maturity, obligor size, max allocations for certain underlying assets, average rating tests, diversity tests | None |

| Structural Protections for Equity Investors | Majority CLO equity holders retain option to refinance or reset debt tranches at lower yields | Lack of consistent documentation between CDO deals; tight structural triggers may keep cashflows out of equity tranche | Typically no optional redemption |

| Use of Derivatives | None | Historical use of credit default swaps | None |

| Resecuritization (investments in other obligations) | None | Historically have invested in other CDOs (i.e., "CDO squared"), increasing concentration risk | None |

| Average Default Rate (1993-2020)1 | 1.7% | 33.4% | 29.4% |

1 Source: Moody’s Investment Service, Impairment and loss rates of structured finance securities: 1993-2020. Average of cumulative multi-year loss rates by original rating.

Distinguishing CLO Features and Benefits

Collateralized loan obligations offer significant differentiators over other structured credit instruments: mainly structural safeguards, mandatory diversification, and active management.

Structural Safeguards

CLOs have detailed protections that are above and beyond typical commingled pools or securitized products. For example, tests on the collateral’s quality require that the principal value of the senior secured loan pool exceed the value of CLO’s obligations to investors (called “over-collateralization.”)

Additionally, the CLO debt tranches’ cost of financing above the benchmark rate (in other words, the total weighted average tranche yields) is locked for the life of the loan. However, the overall market environment may experience a change in corporate credit spreads which may negatively impact the subordinate tranche investors. To help protect against this, CLOs have provisions that can renegotiate some or all the higher debt tranches after a certain period to lower yields (called a “reset” or “refinancing”). Conceptually, this is similar to a homeowner refinancing a home loan to a lower rate if the market environment is favorable, relative to her specific loan rate.

Mandatory Diversification

CLOs have a variety of stipulated diversification requirements that when layered together provide additional benefits to investors. Each individual CLO must meet diversification requirements for number of issuers (typically 150-200 distinct issuers), industry exposure (typically <10% to a single industry), credit quality (weighted average rating must exceed a certain minimum), and underlying loan characteristics (such as a maximum weighted average life of underlying loans). These requirements may help in preventing concentrated exposure and may reduce idiosyncratic risk. This diversification is significantly less stringent in CDOs and CMBS.

Active Management

The third and possibly most differentiating feature of collateralized loan obligations is the active management afforded by the structure. Whereas other securitized products are passively created (a “set and forget” approach), CLOs have institutional managers that actively trade the underlying loans, similar to a mutual fund manager.

Investment managers often specialize exclusively in the senior secured loan investment category and may opportunistically buy underrated securities that pay attractive yields. The finite and closed-end nature of CLOs gives managers the flexibility to opportunistically purchase SSLs during periods of market dislocation and higher loan mispricing. Loans may be excessively discounted during sentiment-driven selloffs, and managers may utilize cash flow generated from the CLO to take advantage of such opportunities.

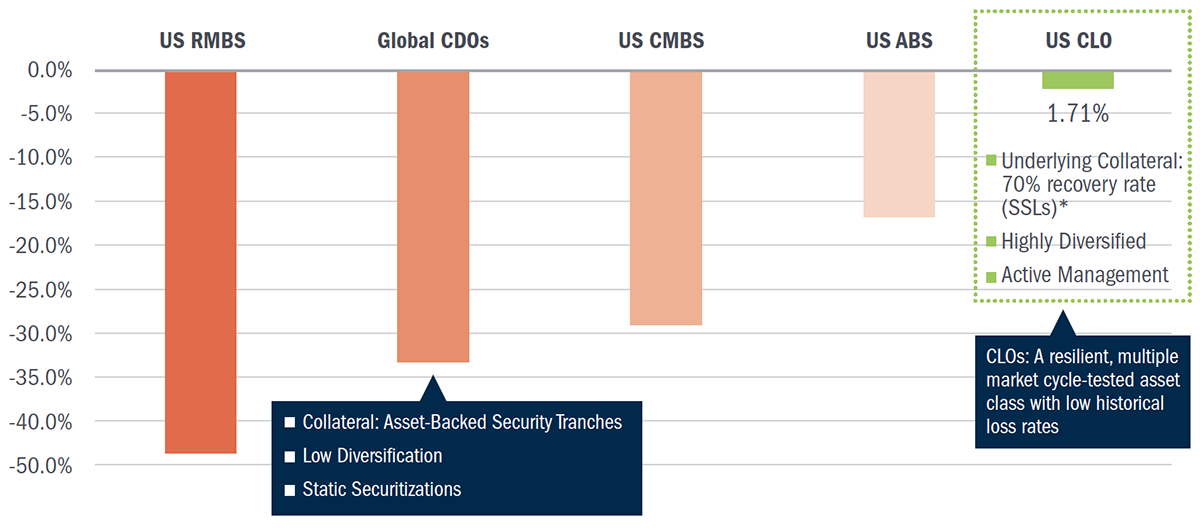

These three characteristics are essential and effective tools in minimizing individual credit exposure and reducing default and loss rates. Figure 2 shows this numerically; CLOs have experienced significantly lower losses, as measured by loss rates, compared to other structured credit instruments. The lower loss rates include periods through the global financial crisis, and is highly indicative of the CLO structure’s robustness.

Figure 2 – Average Loss Rates | 10-year Rolling Periods (1993-2020)

Source: Moody’s Investors Service Annual Default Study 2020. Not representative of an index, see definitions for more information. Multi-year loss rates are average losses over all 10-year periods between 1993 and 2020. Data represents average losses from all known non-investment grade issuances of the individual categories. Past Performance is not a guarantee of future results.

LIBOR– London Inter-Bank Offered Rate, is an interest rate average calculated from estimates submitted by the leading banks in London. It is the primary benchmark for short-term interest rates around the world. LIBOR is scheduled to end mid-2023.

SOFR– Secured Overnight Financing Rate, is a secured interbank overnight interest rate, and is a reference rate that is established as a replacement to LIBOR.

Securitization– The financial practice of pooling various types of debt such as residential mortgages, commercial mortgages, or corporate loans and selling their related cash flows to third party investors as securities, which may be described as bonds or pass-through securities. Investors are repaid from the principal and interest cash flows collected from the underlying debt and redistributed through the capital structure of the new financing.

Obligor– The party bearing a legal obligation to another party, typically within a contract.

Collateral Quality Tests– Rules and limits that are designed to place restrictions on how CLO managers can trade when these tests are breached, such as minimum weighted average spread/coupon, minimum credit rating, minimum diversity score (which measures diversification, and minimum average loan life. If any test is breached the CLO manager must maintain or improve the test value when reinvesting.

This information is educational in nature and does not constitute a financial promotion, investment advice or an inducement or incitement to participate in any product, offering or investment. Bluerock is not adopting, making a recommendation for or endorsing any investment strategy or particular security. All opinions are subject to change without notice, and you should always obtain current information and perform due diligence before participating in any investment. All investing is subject to risk, including the possible loss of principal. Bluerock cannot guarantee that the information herein is accurate, complete or timely. Past Performance does not guarantee future results.