Indicators for Bullish Outlook for Institutional Private Real Estate

Institutional private real estate, as measured by the NCREIF Property Index (NPI), rebounded sharply in 2021 from a below average return in 2020. Four key indicators tell us why there is continued opportunity for real estate values to rise and why institutional real estate is an attractive asset class for today’s investors.

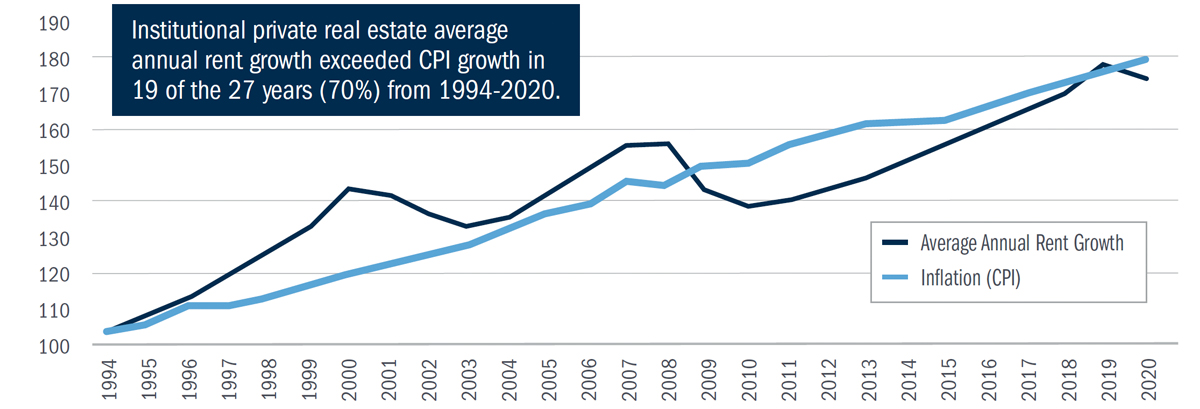

1. Inflation Hedging:

With inflation rates at 40 year highs, investors should consider asset classes that have historically performed well in inflationary environments. Institutional private real estate rents have historically risen with the Consumer Price Index (CPI) and even exceeded CPI growth in 19 of the 27 years from 1994-2020.

Average Annual Rent Growth vs. Inflation (CPI)1

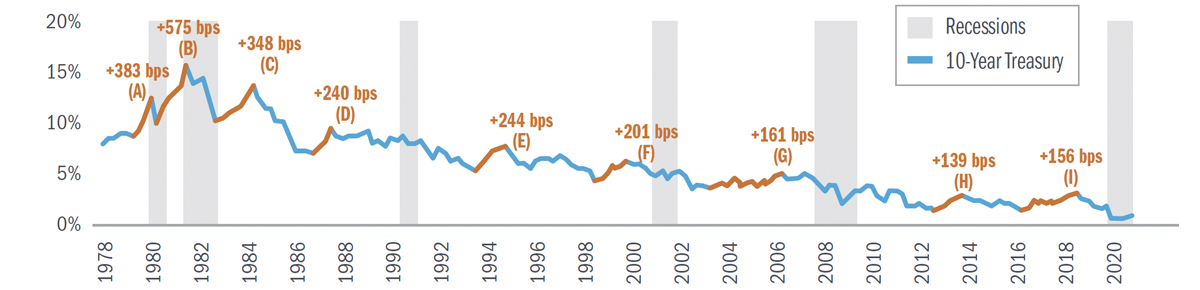

2. Hedge Against Rising Interest Rates:

While fixed income investments are challenged in rising rate environments, institutional private real estate’s ability to increase rents strengthens during strong growth periods, which typically coincide with rising rate periods. The leading institutional private real estate index (NPI) has reported positive total returns in all nine periods of rising 10-year Treasury yields since 1978. It has outperformed the Barclays U.S. Aggregate Bond Index in all but one of these periods making it a good alternative income substitute during these periods.

NPI Positive During the Past 9 Periods of Rising Interest Rates (10-Year Treasury)2

| Interest Rate Increase Periods | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| NPI Total Return | |||||||||

| Bonds Total Return |

bps = basis point, or 1/100th of a percent

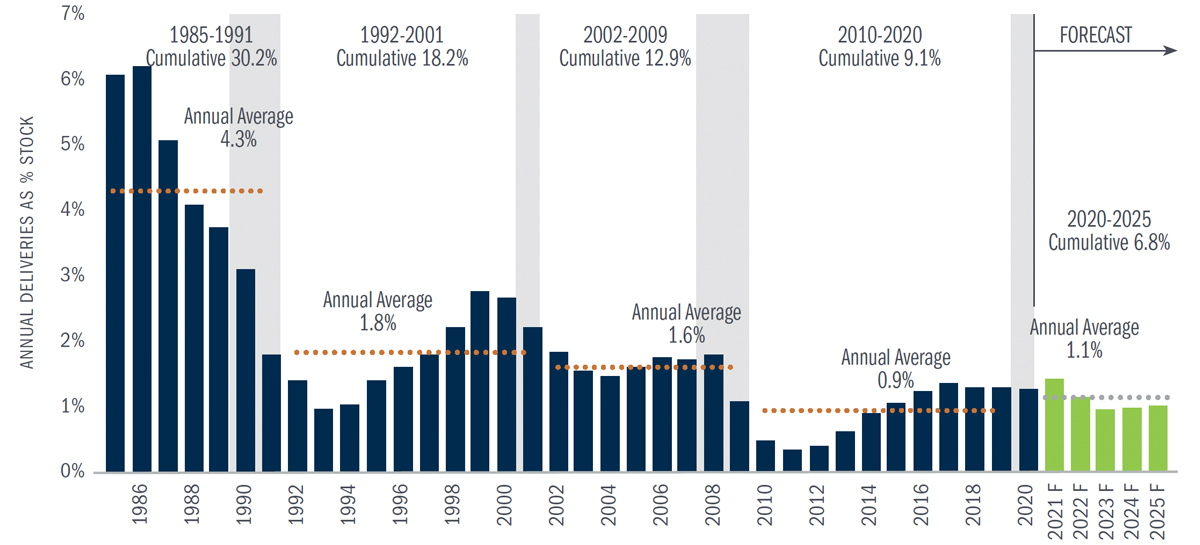

3. Constrained New Supply:

The last decade has seen the lowest amount of new space delivered as a percent of total inventory than any of the prior three decades. Disciplined new construction will help to keep occupancy rates and rent increases high, pushing values higher.

Cumulative and Average New Supply (% of Stock)3

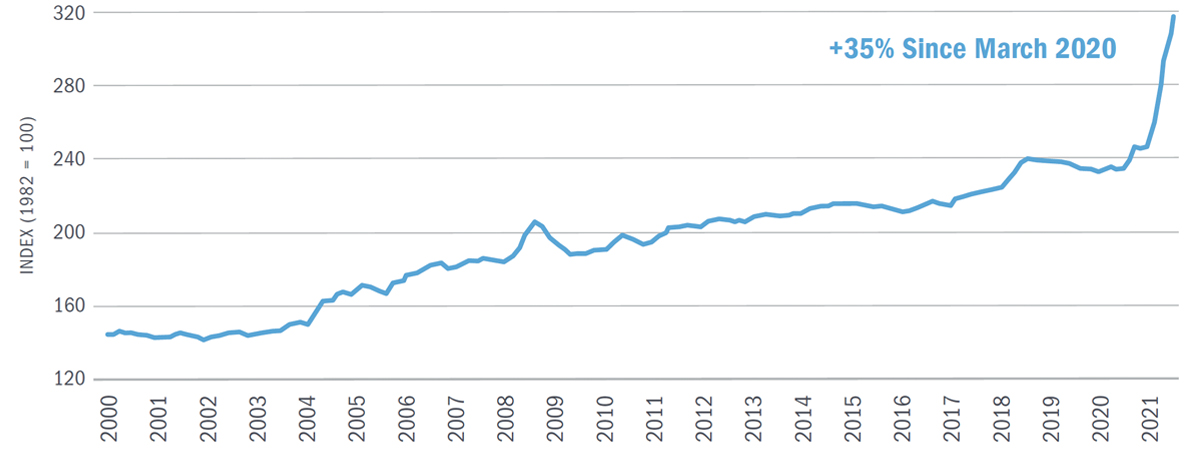

4. Higher Construction Costs:

Inflation has hit the producer side more significantly than the consumer side. Soaring construction costs make it much more expensive to deliver new supply, which pushes values above the new, higher replacement costs.

Producer Price Index (PPI) for Construction Materials (2000-2021)4

1 Source: Clarion Partners: Commercial Real Estate and Inflation-Resistant Income, October 2021

2 Source: Clarion Partners House View, April 2021

3 Source: CBRE-EA, Clarion Partners Investment Research, Q2 2021 Note: Forecasts were provided by Clarion Partners Investment Research as of Q2 2021 based on historic data from CBRE-EA. Cumulative new supply was calculated from the beginning of the cycle to the end of recession. Past performance is not indicative of future results. Forecasts have certain inherent limitations and are based on complex calculations and formulas that contain substantial subjectivity and should not be relied upon as being indicative of future performance.

4 Source: U.S. Bureau of Labor Statistics, Clarion Partners Investment Research 2021

This information is educational in nature and does not constitute a financial promotion, investment advice or an inducement or incitement to participate in any product, offering or investment. Bluerock is not adopting, making a recommendation for or endorsing any investment strategy or particular security. All opinions are subject to change without notice, and you should always obtain current information and perform due diligence before participating in any investment. All investing is subject to risk, including the possible loss of principal. Bluerock cannot guarantee that the information herein is accurate, complete or timely. Past Performance does not guarantee future results.