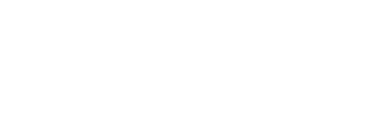

CLO Yields Attractive vs Similar Rated Corporate Debt

Collateralized loan obligation (CLO) debt yields are well above similar rated corporate debt, presenting an opportunity for savvy income investors. Fixed rate corporate debt yields currently reflect historically very low spreads vs risk free rates. CLOs, which are essentially pools of senior secured loans are...