The Case for Investment in the Single-Family Rental Sector

The single-family rental industry continues to benefit from the elusiveness of homeownership, caused by a (i) shortage of housing, (ii) skyrocketing housing prices coupled with increasing interest rates, (iii) record household formation, and (iv) lack of institutionalization in the single-family rental sector.

Continuous Housing Shortage

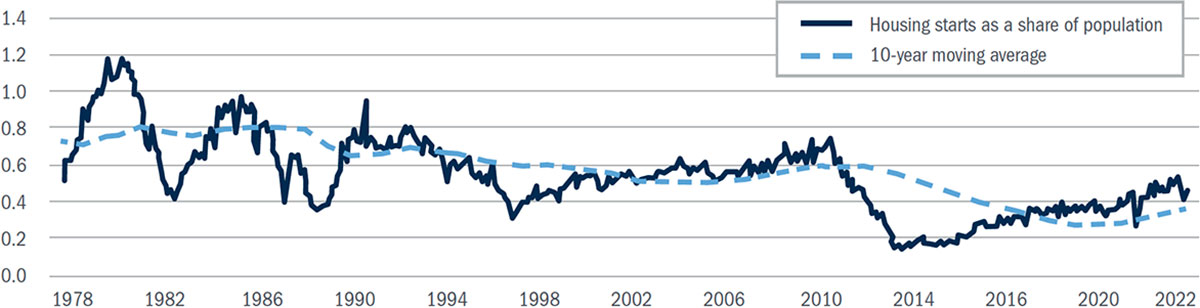

- The national housing shortage has worsened since the Great Financial Crisis. According to the National Multifamily Housing Council, overall demographic growth is expected to generate demand for another 3.7 million new rental properties through 2035. As shown below, the late 1970s and early 1980s saw 10 year average housing production at 0.8x population growth, by 2020 the 10-year average housing production had declined to less than 0.4x population growth.

Housing Production Has Not Kept Pace with Population Growth¹

Housing Unaffordability at an All-Time High

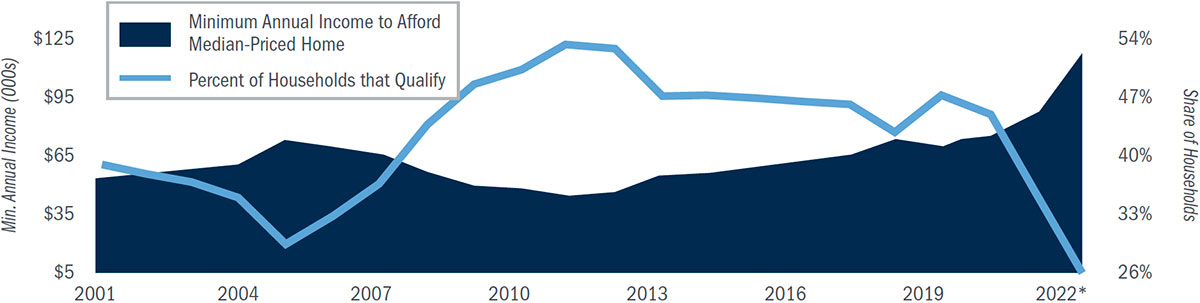

- Housing unaffordability has reached an all-time high. According to Marcus & Millichap, at the end of Q2, it was more than $1,000 a month cheaper to rent an apartment than it was to own a home. As shown below, only 26% of households can afford a home now due to the median household income to own a median priced home eclipsing $120,000. Additionally, households now require 35.1% of the median household income to make a principal and interest payment on the median home with a 20% down payment, the highest it has been since October 1985.

Home Ownership Potential Limited by High Prices and Mortgage Rates²

* Income through mid-June; Households through April

Changes in Demographics

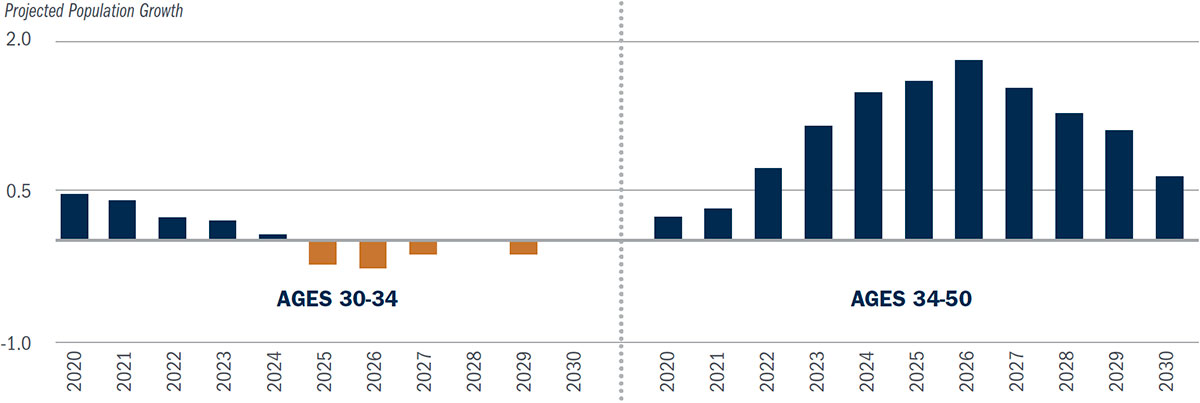

- Demographic trends, driven by the Millennial generation, continue to support the single-family rental industry. The Millennial generation is entering their prime household formation years and are searching for more space. As shown below the 34-50 age category is expected to grow by approximately 17 million households. Due to the unaffordability of owning a home, many will continue to rent longer than the previous generations, providing a strong tailwind to the single-family rental industry.

Millennials in Prime Household Formation Years are Driving SFR Housing Demand³

Institutionalization of the Single-Family Rental Sector

- The single-family rental industry is highly fragmented and has garnered attention from institutional investors, such as Bluerock. According to Morgan Stanley, only 2%, or 300,000 units, are institutionally owned, while the other 98% of single-family rental properties are owned by individual “mom and pop” investors. The lack of institutionalization provides strong tailwinds for outsized growth and potential for economies of scale in the sector.

Current market conditions are expected to persist with strong rental growth driven by low vacancy rates in the single-family rental sector. The rental market has received an unlikely ally in the housing shortage and the for-sale market. Households once seeking to own will likely be forced back into the rental market spurring even greater demand. While numerous investment opportunities abound, the pending institutionalization of the single-family rental sector appears to offer substantial runway and scalability forming a strong investment thesis for the next decade.

¹ Source: Federal Reserve Economic Data, August 2022

² Source: Marcus & Millichap, 3Q 2022 Multifamily Report; finance.yahoo.com/span>

³ Source: AMH Research, U.S. Census Bureau/span>

This information is educational in nature and does not constitute a financial promotion, investment advice or an inducement or incitement to participate in any product, offering or investment. Bluerock is not adopting, making a recommendation for or endorsing any investment strategy or particular security. All opinions are subject to change without notice, and you should always obtain current information and perform due diligence before participating in any investment. All investing is subject to risk, including the possible loss of principal. Bluerock cannot guarantee that the information herein is accurate, complete or timely. Past Performance does not guarantee future results./span>