Why Individual Investors Should Consider Seeking Alternative Credit

Traditional fixed income failed to deliver positive returns in 2022. Headlines have been reporting that bond returns delivered the worst year in U.S. history with a return of -13.0%1 for the Bloomberg US Aggregate Bond Index, which is a widely used measure of the publicly traded bond market. The main driver of fixed income losses has been the Federal Reserve’s unexpectedly rapid increase in interest rates in response to inflation. Additionally, an unprecedented increase in fiscal spending during the pandemic increased government’s borrowing costs on the longer end of the yield curve, which has also impacted rates (and thus bond prices).

However, the fixed income asset class is extremely broad (some estimates range as large as $52 trillion2), with many categories and opportunities beyond the public bond market. One of the most noteworthy categories today is alternative credit, which is distinct from mainstream fixed income securities such as U.S. Treasuries, high-quality corporate bonds, and municipal bonds.

This alternative category has been expanding in size in the last decade, as the low interest rate environment drove investors to seek higher nominal yields. Today, investors have continued investing in the category in search of real yields (to mitigate the effect of today’s high inflation rate). However, this category has been historically limited to institutions because of large investment minimums and more limited liquidity than compared to publicly traded equities.

Search for Meaningful Income and Attractive Risk-Adjusted Returns

Bluerock has sought investment categories that have demonstrated asymmetrical reward profiles: attractive total return with potential for lower volatility. We believe that the alternative credit asset class fits this description: differentiated, alternative strategies that target equity-like total return potential and meaningful income while offering individuals access to investments typically only available to institutions.

One such pocket of alternative credit is structured credit. Structured credit refers to specialized securities that pool certain debt obligations and subsequently provide access to a wide range of debt investors such as banks, insurance companies, and pension plans to participate in the debt ownership. This occurs through a securitization process in which the strategy’s investors are categorized by tranche depending on their return objective and risk tolerance, and receive cash flows in varying amounts depending on the tranche they selected.

One type of security described above is called collateralized loan obligations (CLOs) that are structured with senior secured loans (or SSLs, which represent the highest claim on a company’s cash and assets) as the debt obligations for cash flow generation. Furthermore, these products also have various embedded structural safeguards and mandated covenants stipulated in the offering documents that help in reducing risk for investors across the different tranches. This has historically contributed to lower realized loss rates when compared to traditional fixed income securities.

Notable Advantages in Today’s Uncertain Market

We’ve identified three main advantages for CLOs. The first is the category’s minimal price sensitivity to rising interest rates, given its floating rate nature. This acts as a potential hedge to inflation, given that the interest rates adjust upwards as the Federal Reserve increases the Fed Funds rate.

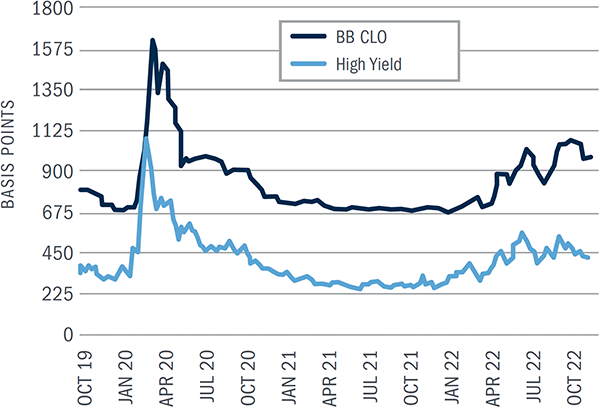

The second is CLOs’ higher income potential, especially when compared to equivalent yields for publicly available asset classes. Figure 1 (at right) shows spread and discount margins for CLOs and high yield securities. Discount margins are a floating rate measure of expected income generation and are significantly higher for BB CLO3 securities than the rate for high yield bonds.

The third appealing characteristic is the investment category’s lower correlation to broader markets. This is a characteristic that is especially important in today’s volatile and uncertain environment and where the traditional “60/40” portfolio has recently shown reduced ability to generate meaningful returns or in reducing risk.

For example, the Palmer Square BB index, a commonly used index for CLOs , has shown a low 0.20 90-day correlation with the S&P 500 as of Dec 1, 2022. Additionally, this same index has shown a 0.27 correlation with the Bloomberg Aggregate Bond Index for the same date (and was negative to this index from January through July of the same year).

Figure 1: BB vs High Yield Spreads above LIBOR

Source: Whitestar Asset Management, LCD, Bloomberg

Importantly, default and loss rates are also lower for this category. Figure 2 below shows loss rates for various fixed income investment categories. CLO investments have shown the lowest loss rates (a metric that accounts for fixed income defaults and recoveries from these defaults) for approximately the last two and half decades.

An Appealing Investment Class for Today’s World

Effective management of CLOs can offer high current income with attractive risk-adjusted returns and a lower correlation to broader markets. Investments in CLOs, through appropriately structured vehicles such as interval funds, can offer these qualities while also benefiting from lower loss rates than comparable securities or than investing directly in senior loans. Investors should seriously consider alternative credit especially in today’s investing environment.

Figure 2: % Net Loss Rates by Asset Type & Rating

| AAA | AA | A | BBB+ | BBB | Below IG | |

| CLO 1995-2019 (%) | 0.00% | 0.00% | 0.00% | 0.30% | 0.70% | 0.80% |

| IG/Below IG Bonds 1983-2019 (%) | 0.04% | 0.19% | 0.47% | 0.88% | 4.84% | 12.19% |

| ABC 1993-2019 (%) | 0.26% | 2.31% | 2.56% | 5.23% | 10.92% | 14.14% |

| CMBS 1993-2019 (%) | 1.12% | 6.20% | 11.66% | 18.37% | 29.26% | 30.89% |

Source: Citigroup, Moody’s as of 12.31.19. Point in time study; may be updated infrequently. Not representative of an index. See footnote for type definitions.

1 As of December 1, 2022; The Bloomberg US Agg Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS and CMBS (agency and non-agency).

2 https://www.sifma.org/resources/research/us-fixed-income-securities-statistics

3 BB CLOs: are a specific tranche of CLOs that are rated BB by major rating agencies.

ABS: An asset-backed security, a type of financial investment that is collateralized, usually by loans, leases, credit card balances, or receivables.

CMBS: Commercial mortgage-backed securities, which are fixed-income investment products that are backed by mortgages on commercial properties rather than residential real estate.

IG/Below IG Bonds: investment-grade bonds, typically BBB/Baa or above, and below investment-grade bonds, typically BB+/Ba1 or below.

This information is educational in nature and does not constitute a financial promotion, investment advice or an inducement or incitement to participate in any product, offering or investment. Bluerock is not adopting, making a recommendation for or endorsing any investment strategy or particular security. All opinions are subject to change without notice, and you should always obtain current information and perform due diligence before participating in any investment. All investing is subject to risk, including the possible loss of principal. Bluerock cannot guarantee that the information herein is accurate, complete or timely. Past Performance does not guarantee future results.