Analyzing Demographics to Target Real Estate Investment Opportunities

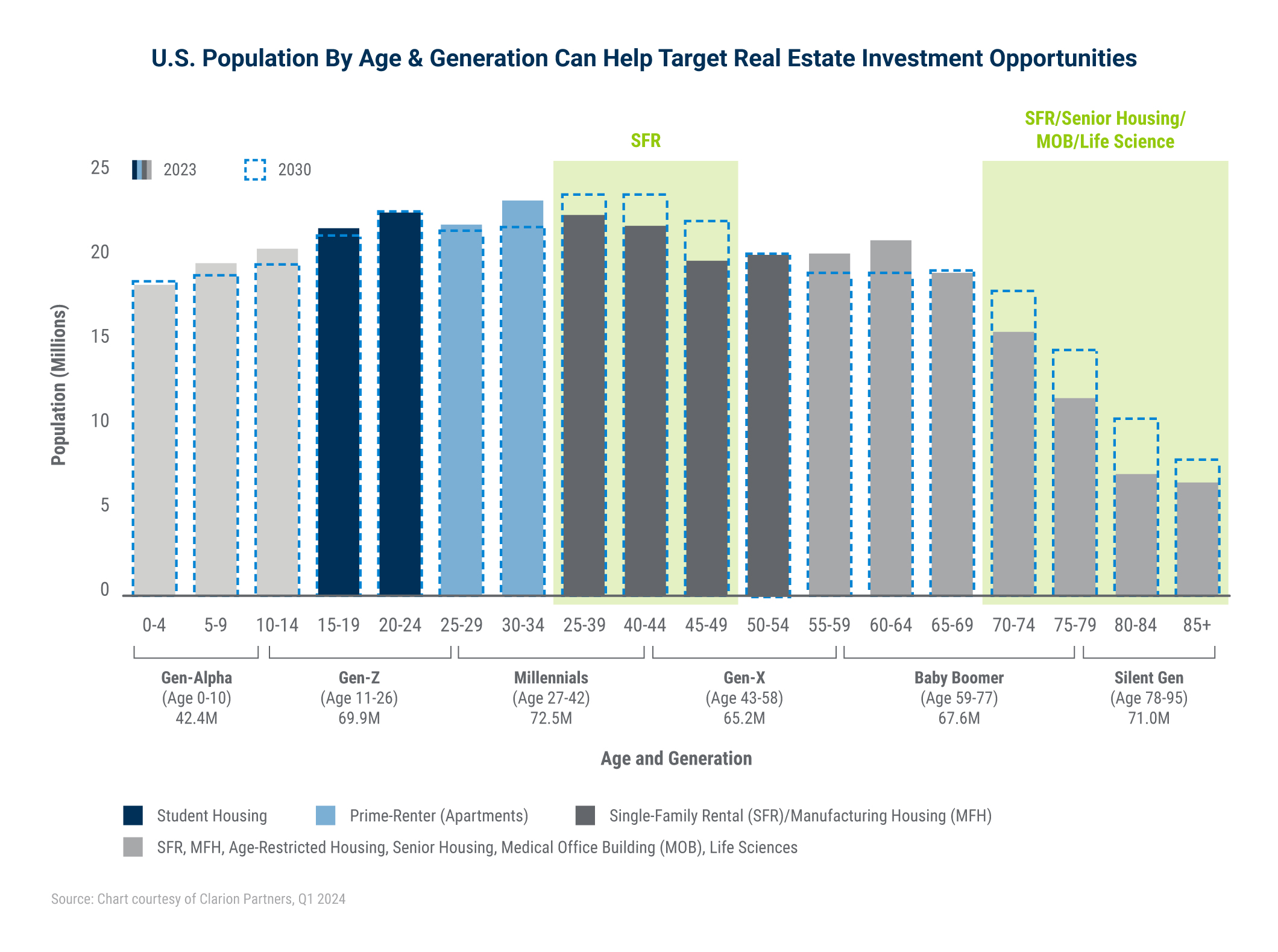

Demographics are key in real estate investing. Just as targeting future growth geographies pays off, so too can understanding aging trends and how that may impact demand for real estate sectors. As our chart of the month shows, by 2030, significant increases are projected in the 35-49 aged cohorts (approximately 6 million) and the 70+ aged cohorts (approximately 9-10 million) while people under the age of 35 is expected to be lower. This has significant implications for real estate demand as single family rentals emerge as a favored sector, particularly for the 35-49 category and life sciences, senior housing, and medical office buildings come into focus for the 70+ aged cohorts. We believe investors should be cognizant of thematic-based investing including demographics and other lifestyle trends including e-commerce adoption, artificial intelligence, and geographic preferences.