Bluerock Homes Trust

Series A Redeemable Preferred Stock

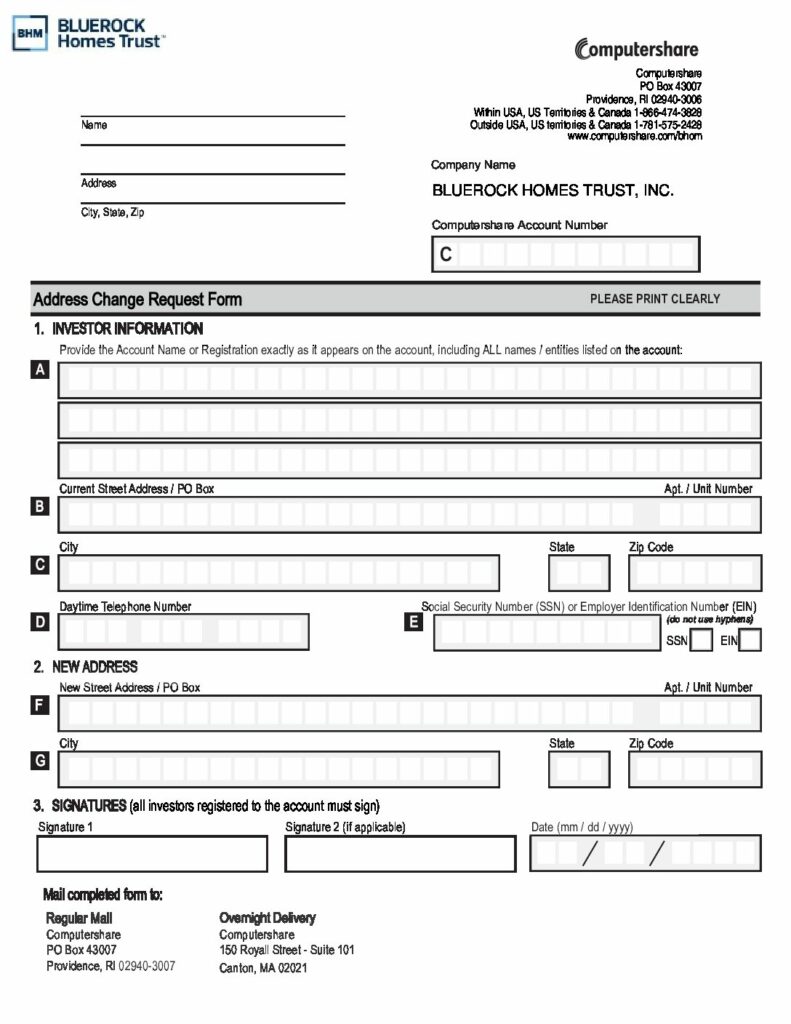

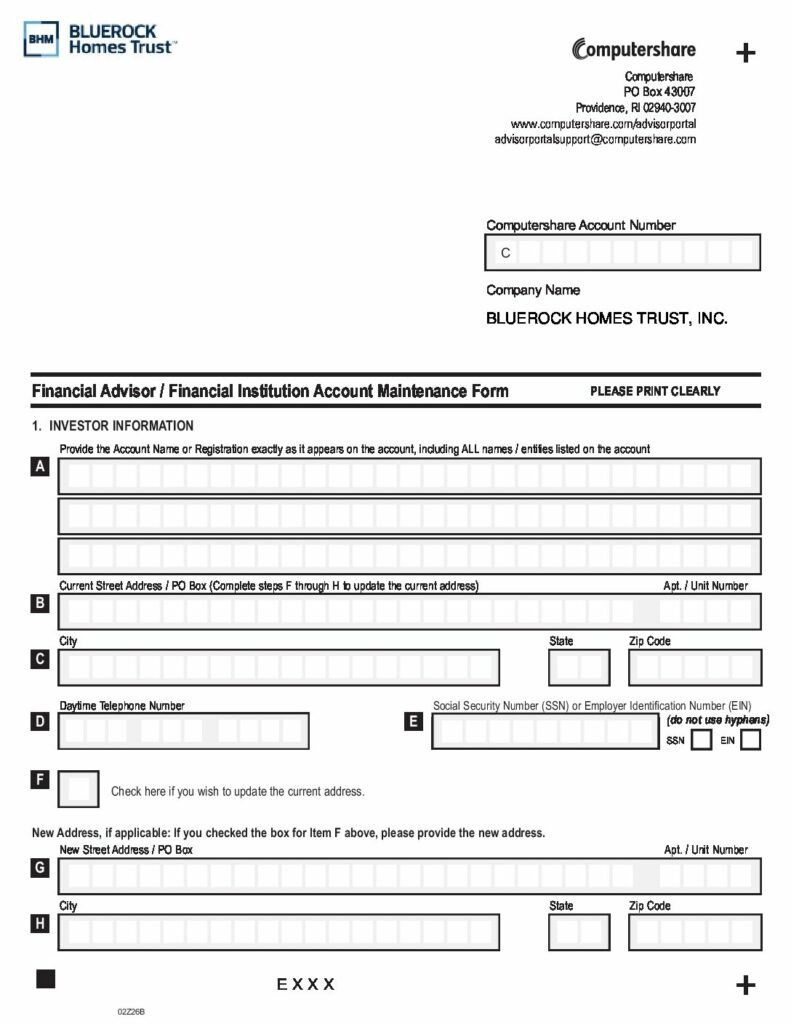

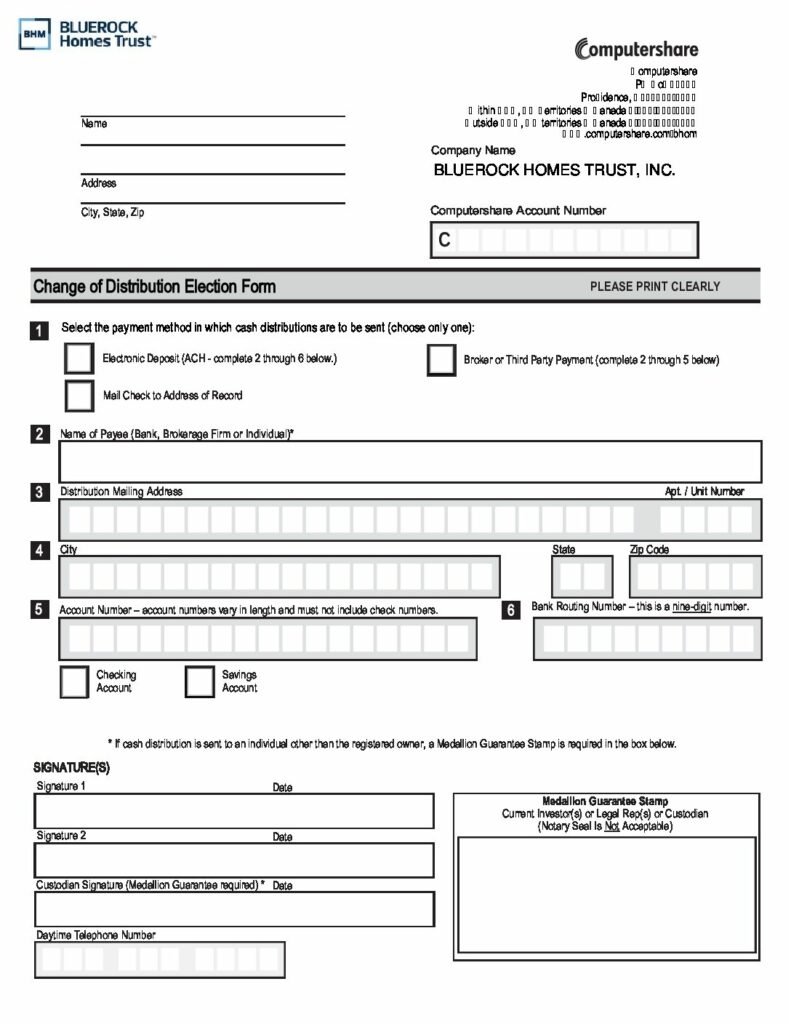

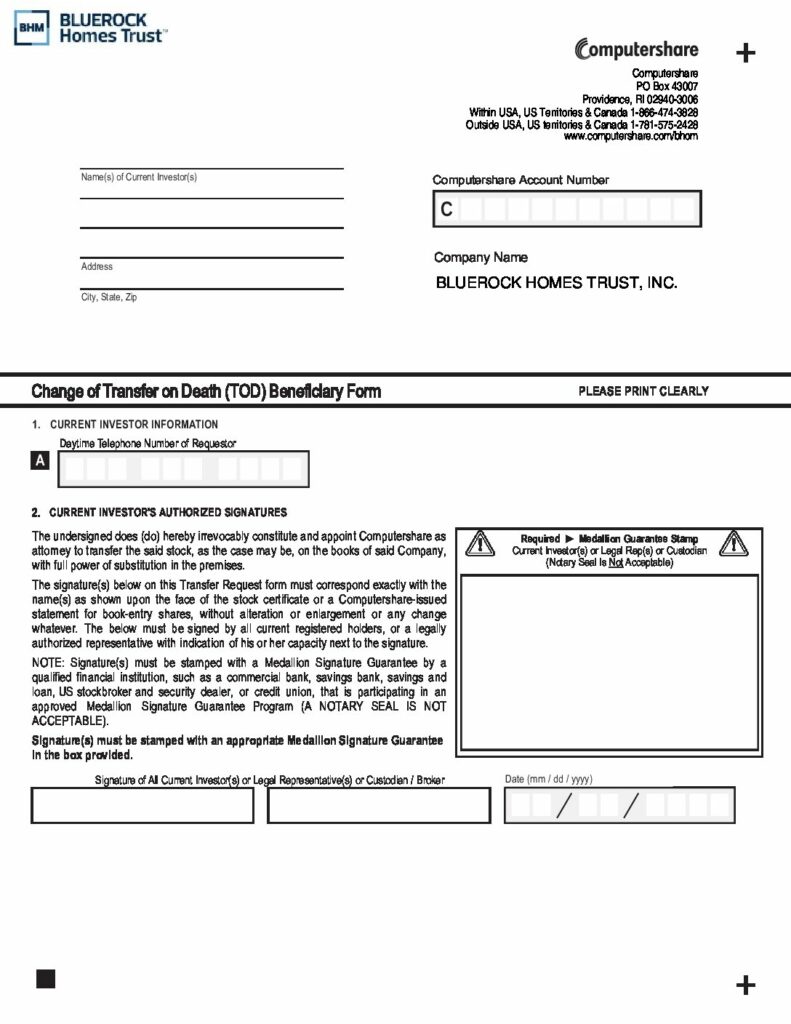

Documents & Forms

Dividend Distributions

| Record Date | Paid Date | Stated Dividend Rate | Special Dividend | Total Dividend |

|---|---|---|---|---|

| 3/25/24 | 4/5/24 | $0.125000 | $0.004603 | $0.129603 |

| 2/23/24 | 3/5/24 | $0.125000 | $0.003458 | $0.128458 |

| 1/25/24 | 2/5/24 | $0.125000 | $0.000337 | $0.125337 |

| 12/22/23 | 1/5/24 | $0.125000 | $0.002469 | $0.127469 |

| 11/24/23 | 12/5/23 | $0.125000 | $0.012550 | $0.137550 |

| 10/25/23 | 11/3/23 | $0.125000 | $0.125000 | |

| 9/25/23 | 10/5/23 | $0.125000 | $0.125000 | |

| 8/25/23 | 10/5/23 | $0.125000 | $0.125000 |

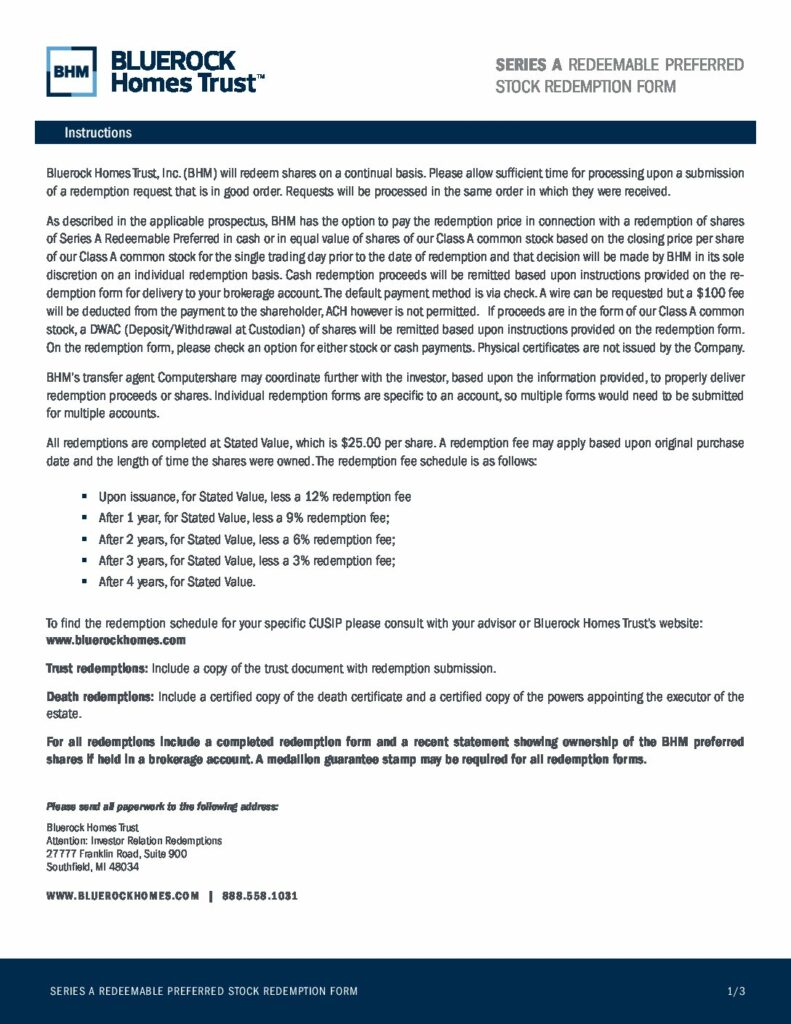

Redemption Fee Schedule

| CUSIP # | Issue Date | 12% | 9% | 6% | 3% | 0% |

|---|---|---|---|---|---|---|

| 09631H779 | 4/26/24 | 4/26/24 | 4/26/25 | 4/26/26 | 4/26/27 | 4/26/28 |

| 09631H787 | 4/12/24 | 4/12/24 | 4/12/25 | 4/12/26 | 4/12/27 | 4/12/28 |

| 09631H795 | 3/22/24 | 3/22/24 | 3/22/25 | 3/22/26 | 3/22/27 | 3/22/28 |

| 09631H811 | 3/8/24 | 3/8/24 | 3/8/25 | 3/8/26 | 3/8/27 | 3/8/28 |

| 09631H829 | 2/23/24 | 2/23/24 | 2/23/25 | 2/23/26 | 2/23/27 | 2/23/28 |

| 09631H837 | 2/9/24 | 2/9/24 | 2/9/25 | 2/9/26 | 2/9/27 | 2/9/28 |

| 09631H845 | 1/26/24 | 1/26/24 | 1/26/25 | 1/26/26 | 1/26/27 | 1/26/28 |

| 09631H852 | 1/12/24 | 1/12/24 | 1/12/25 | 1/12/26 | 1/12/27 | 1/12/28 |

| 09631H860 | 12/22/23 | 12/22/23 | 12/22/24 | 12/22/25 | 12/22/26 | 12/22/27 |

| 09631H878 | 12/8/23 | 12/8/23 | 12/8/24 | 12/8/25 | 12/8/26 | 12/8/27 |

| 09631H886 | 11/17/23 | 11/17/23 | 11/17/24 | 11/17/25 | 11/17/26 | 11/17/27 |

| 09631H803 | 11/3/23 | 11/3/23 | 11/3/24 | 11/3/25 | 11/3/26 | 11/3/27 |

| 09631H704 | 10/20/23 | 10/20/23 | 10/20/24 | 10/20/25 | 10/20/26 | 10/20/27 |

| 09631H605 | 10/6/23 | 10/6/23 | 10/6/24 | 10/6/25 | 10/6/26 | 10/6/27 |

| 09631H506 | 9/22/23 | 9/22/23 | 9/22/24 | 9/22/25 | 9/22/26 | 9/22/27 |

| 09631H308 | 8/25/23 | 8/25/23 | 8/25/24 | 8/25/25 | 8/25/26 | 8/25/27 |

| 09631H209 | 8/11/23 | 8/11/23 | 8/11/24 | 8/11/25 | 8/11/26 | 8/11/27 |

Learn more about the Bluerock Homes Trust’s Series A Redeemable Preferred Stock

¹ Payment of Dividends is not guaranteed. Reflects the regular monthly dividend of $0.125 per outstanding share of Series A Preferred Stock (the Series A Preferred Regular Dividends) plus a special dividend (the “Series A Preferred Special Dividends”) which shall be declared for each month for which the Board declares the Series A Preferred Regular Dividends, and shall be payable to the extent the average 10-Year Daily Treasury Par Yield Curve Rate (the “10-Year Treasury Rate”) exceeds 4.0%. The Series A Preferred Special Dividends will be aggregated and payable in cash on the 5th day of the following month. The average 10-Year Treasury Rate will be calculated based on the 10-Year Treasury Rate for each day commencing on the 26th day of the prior month and ending on the 25th day of the applicable month. Dividends may be paid from sources other than cash flow from operations. Dividends may represent a return of capital.

The security investment described herein relates solely to BHM’s Series A Redeemable Preferred Stock, a non-traded security of BHM which has not been nor is expected to be listed on any national exchange. The risks and rewards of investing in BHM’s Series A Redeemable Preferred Stock are separate and distinct from an investment in BHM’s Class A common stock listed on the NYSE American.

THIS IS NEITHER AN OFFER TO SELL NOR A SOLICITATION OF AN OFFER TO BUY THE SECURITIES DESCRIBED HEREIN. AN OFFERING IS MADE ONLY BY THE PROSPECTUS AND ANY ACCOMPANYING PROSPECTUS SUPPLEMENT. THIS SALES AND ADVERTISING LITERATURE MUST BE READ IN CONJUNCTION WITH OR ACCOMPANIED BY THE PROSPECTUS AND ANY ACCOMPANYING PROSPECTUS SUPPLEMENT IN ORDER TO UNDERSTAND FULLY ALL OF THE IMPLICATIONS AND RISKS OF THE OFFERING OF SECURITIES TO WHICH IT RELATES. A COPY OF THE PROSPECTUS AND ANY ACCOMPANYING PROSPECTUS SUPPLEMENT MUST BE MADE AVAILABLE TO YOU IN CONNECTION WITH THE OFFERING. NONE OF THE U.S. SECURITIES AND EXCHANGE COMMISSION, THE ATTORNEY GENERAL OF THE STATE OF NEW YORK OR ANY OTHER STATE REGULATORS HAS PASSED ON OR ENDORSED THE MERITS OF THE OFFERING. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

Bluerock Homes Trust, Inc. (NYSE American: BHM) is an externally managed real estate investment trust (REIT) formed to assemble a portfolio of infill first-ring suburban single-family rental homes in knowledge-economy and high quality of life growth markets across the United States, targeting middle-market single-family home renters. We intend to elect to be taxed and operate as a REIT.

An investment in Bluerock Homes Trust (“BHM”) involves substantial risk. See the “Risk Factors” sections of the Prospectus and any accompanying Prospectus Supplement for a discussion of material risks related to an investment in BHM’s Series A Redeemable Preferred Stock, which include, but are not limited to, the following:

- There is no assurance that we will be able to achieve our investment objectives.

- If we are unable to acquire suitable properties or investments, or suffer a delay in doing so, we may not have cash flow available for distribution to you as a stockholder.

- There is currently no public trading market for shares of our Series A Redeemable Preferred Stock, and we do not intend to list them on a securities exchange. As a result, our shares of Series A Redeemable Preferred Stock should be considered as having only limited liquidity and may be illiquid. If you sell your stock, it may be at a substantial discount.

- Other than investments disclosed in a supplement hereto prior to an investor’s investment; investors will not have the opportunity to evaluate the economic or other merits of any of our future investments prior to our making them.

- This is a “best efforts” offering and if we are unable to raise substantial funds, then we may be more limited in our investments.

- We may change our investment policies without stockholder notice or consent, which could result in investments that are different from those described in the Prospectus.

- Some of our executive officers, directors and other key personnel also serve as officers, directors, managers, key personnel and/or holders of an ownership interest in the Manager, the Dealer Manager, and/or their respective affiliates. As a result, they face conflicts of interest, including but not limited to conflicts arising from time constraints, allocation of investment opportunities among their affiliated entities and us, and the Manager’s compensation arrangements with us and other programs advised by them.

- Although dividends on the Series A Redeemable Preferred Stock are cumulative, dividend payments on the Series A Redeemable Preferred Stock are not guaranteed. Our board of directors must approve actual payment of the dividends and can elect at any time not to pay any or all accrued distributions.

- We may fail to qualify as a REIT, which would adversely affect our operations and our ability to make distributions to our stockholders, and may have adverse tax consequences to you.

- Compensation paid to our Manager in connection with transactions involving the management of our investments will be payable regardless of the quality of the investments made or of the services rendered to us. This arrangement could influence our Manager to recommend riskier or unsuitable transactions to us.

- We will rely totally on our Manager to manage our business and assets. Adverse changes in the financial condition of our Manager or its affiliates, or our relationship with our Manager, could adversely affect us and our stockholders.

- Our use of leverage, such as mortgage indebtedness and other borrowings, increases the risk of loss on our investments.

- Distributions paid from sources other than cash flow from operations may constitute a return of capital and reduce investor returns. Rates of distributions to stockholders may not be indicative of our operating results.

- Beginning two years from the date of original issuance, we may redeem the outstanding shares of Series A Redeemable Preferred Stock, without your consent, at 100% of the Stated Value per share, plus any accrued and unpaid dividends in cash or shares of BHM’s Class A Common Stock at BHM’s discretion.

- Holders of shares of Series A Redeemable Preferred Stock will have no voting rights or control over changes in our policies and operations. Our board of directors may approve changes to our policies without your approval.

- Our charter contains various restrictions on the ownership and transfer of our securities.

BHM has filed a registration statement on Form S-11 (No. 333-269415, the “Registration Statement”) with the Securities and Exchange Commission (the “SEC”), including a prospectus (the “Prospectus”), relating to the offering of the Series A Redeemable Preferred Stock and may file from time to time with the SEC a supplement to the Prospectus (each, a “Prospectus Supplement”). A copy of the Prospectus and any accompanying Prospectus Supplement must be made available to you in connection with the offering of the Series A Redeemable Preferred Stock and must be read in conjunction with these materials in order to fully understand the risks of an investment in the offering.

Summary of Fees and Expenses: Investors will be subject to the following Fees and Expenses as part of the Offering: selling commissions, dealer manager fee, and other offering expenses. Please see the Prospectus and any accompanying Prospectus Supplement for a complete listing of all Fees and Expenses related to the Offering.

This material contains forward-looking statements that are subject to risks and uncertainties. These forward-looking statements include information about possible or assumed future results of BHM’s business, financial condition, liquidity, results from operations, plans and objectives. These forward-looking statements are based on BHM’s beliefs, assumptions and expectations of its future performance, taking into account all information currently available to BHM. You should not place undue reliance on these forward-looking statements. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to BHM, and BHM cannot guarantee that BHM will achieve any or all of these expectations.