Bluerock’s Q1 2024 Market Insights Newsletter

In This Issue…

- After a 69% Fall in Sales, is the REIT Winter Over?

- Why Some Investors are Bullish on Private Real Estate

- Cap Rates May Have Hit Their High Point

- BlackRock: Now is the Time to Invest in CRE

- Investors Fueling Growth in Alternative Property Sectors

- Data: The Private Credit Market is Projected to Expand Significantly Through 2028

- Research: BlackRock 2024 Private Markets Outlook

FEATURED CONTENT

After a 69% Fall in Sales, Is the REIT Winter Over?

One might think NTR sales should rebound with market pricing, but many NTRs have not lowered their NAVs in line with most private commercial real estate indexes As Richard Hill indicates: “Another reason that non-traded REIT sales may not rebound quickly is “allocation 101” – investors may be looking to sell out of investments with relatively higher NAVs and pivot into segments that are now discounted,” Hill said. “The logical [move] is sell the thing that has done well and buy the thing that hasn’t done well.”

Source: FundFire

May require a login/subscription to read.

IN THE NEWS

Why Some Investors are Bullish on Private Real Estate

Market dislocations typically bring opportunities. “Investors putting their money to work in core real estate in 2024 and 2025 might see IRRs in the 10.0% to 12.0% range, said James Corl, executive vice president and head of private real estate group with investment manager Cohen & Steers.”

Source: Wealth Management

Cap Rates May Have Hit Their High Point

Rising cap rates have been the culprit behind falling real estate valuations decade, but most market participants now believe cap rates have peaked A big part of the consensus thinking is that both short term and longer term interest rates have peaked, both of which influence cap rates.

Source: Globest.com

BlackRock: Now is the Time to Invest in CRE

BlackRock’s recent report is very bullish on private real estate and they believe it’s a great time to enter the asset class. They wrote: “Following three recent downturns, real estate has generated strong returns fueled by improving fundamentals and capital appreciation. Investors today have an advantage to acquire assets at below replacement cost and can potentially take advantage of growing distress in the market.”

Source: Globest.com

Investors Fueling Growth in Alternative Property Sectors

Alternative sectors include senior housing, student housing, life sciences, medical offices, data centers, and self-storage and tend to be demographically driven, not economically cyclical According to Harrison Street’s analysis of NCREIF data from Q4 2011 through Q1 2023, alternative sectors have undergone a 14.4 percent average annualized total return compared to average returns of 8.3 percent for traditional sector assets.

Source: Urban Land: uli.org

NEW DATA

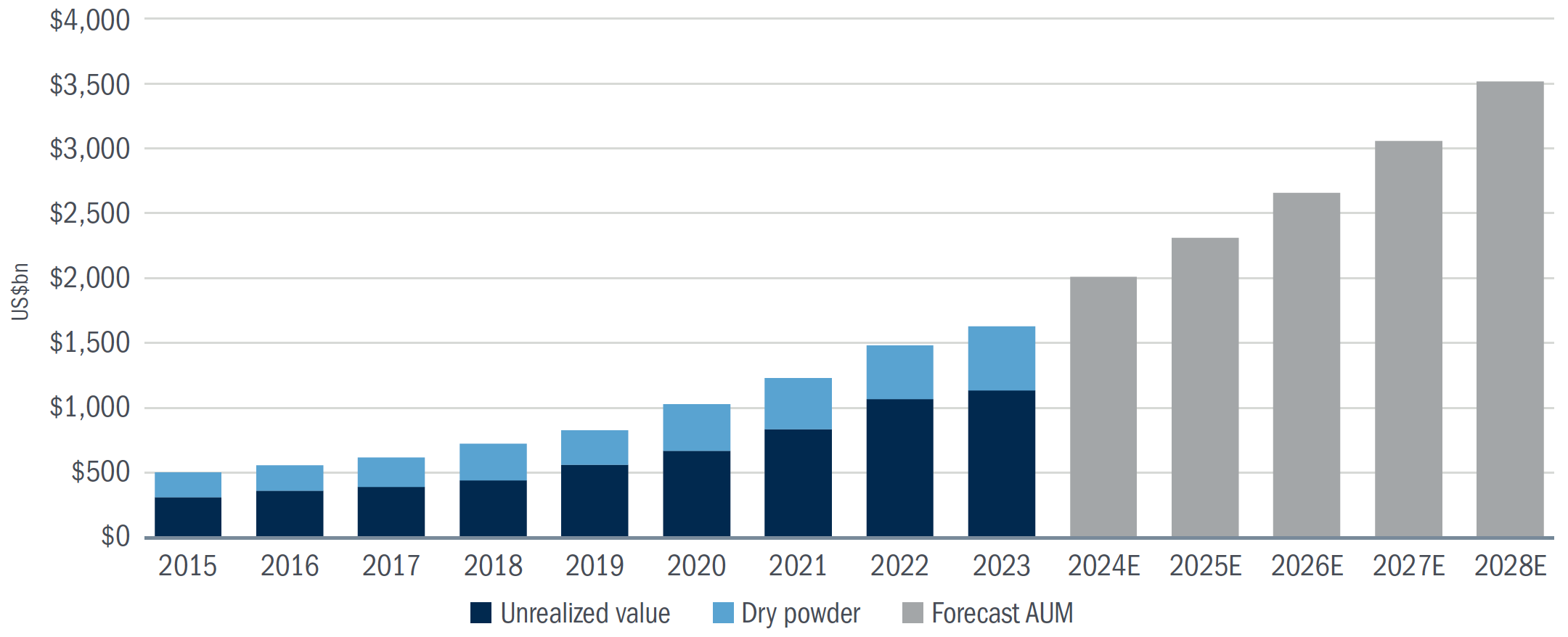

The Private Credit Market is Projected to Expand Significantly Through 2028

Source: BlackRock 2024 Private Markets Outlook

NEW RESEARCH

BlackRock 2024 Private Markets Outlook | 2024

In real estate, it’s an opportune time for investors with dry powder to take advantage of the market dislocation by acquiring high-quality properties at valuations not seen for almost a decade.

While real estate values are resetting, there are attractive opportunities in several property types, including industrial and logistics, necessity retail and some types of residential.

Tectonic shifts are underway in the U.S. financial sector, which are changing the markets for deposits and credit. A key beneficiary of this structural shift, in our view, is the private debt market.

We see the potential for the global private debt market to reach US$3.5 trillion in AUM by year-end 2028, up from US$1.6 trillion globally, as of March 2023.

Read Full ReportHistorically, the real estate asset class tends to perform well after periods of dislocation. And we believe this environment of repricing amid steady market fundamentals represents a great opportunity.

QUOTES OF THE QUARTER

“We believe values in commercial real estate are bottoming,” he said. “The cost of capital appears to have peaked as borrowing spreads have begun to tighten and the Fed is no longer raising rates but likely cutting them in 2024. Also importantly, new construction starts have started to move down sharply in commercial real estate... while it will take time, we can see the pillars of a real estate recovery coming into place.”

JON GRAY

Blackstone President and Chief Operating Officer

It (core real estate) really is an interesting area that’s been out of favor, and some might find it a little boring because it doesn’t offer yields in the teens, But we like those areas of the market that produce very stable returns and have lower leverage. They form a good core of the portfolio.

GARY QUINZEL

Vice President of Portfolio Consulting, Wealth Enhancement Group

Read more insights on the Bluerock Library.