Bluerock’s Q2 2022 Market Insights Newsletter

In This Issue…

- The Opportunity Lens Widens For Alternative Investments

- Rents Nationwide ‘Increase At Record Level Rates’

- Prologis: E-Commerce Market Share Will Climb Higher

- A Look At Leveraged Loans and CLOs

- Sentiment Remains Strong For The SFR Sector

- New Data – Industrial An Increasingly Essential Property Type

- Research Report – Marcus And Millichap US Industrial Investment Forecast

FEATURED CONTENT

The Opportunity Lens Widens For Alternative Investments

Investor and advisor concerns over both stocks and bonds are drawing more attention to alternatives.

Source: Wealth Management

IN THE NEWS

Rents Nationwide ‘Increase At Record Level Rates’

Single-family rents have more or less mirrored what is happening with housing prices – soaring prices which appear on track to continue the rest of the year.

Source: Yahoo Finance

Prologis: E-Commerce Market Share Will Climb Higher

It’s likely that Amazon concerns are overblown as the nation’s largest industrial landlord believes e-commerce market share is poised to rise based on demand for faster deliver times and online sales technologies.

Source: Globe’s

A Look At Leverage Loans and CLOs

CLOs stand to gain wider traction given their understanding is in the early stages and investors have yet to understand their potential for income, capital preservation, and performance.

Source: Advisor Perspectives

Sentiment Remains Strong For The SFR Sector

In a clear sign that single family rentals are becoming a more institutional investment, market participants plan to accumulate more assets and are generally expecting demand and occupancy rates to further increase.

Source: Wealth Management

NEW DATA

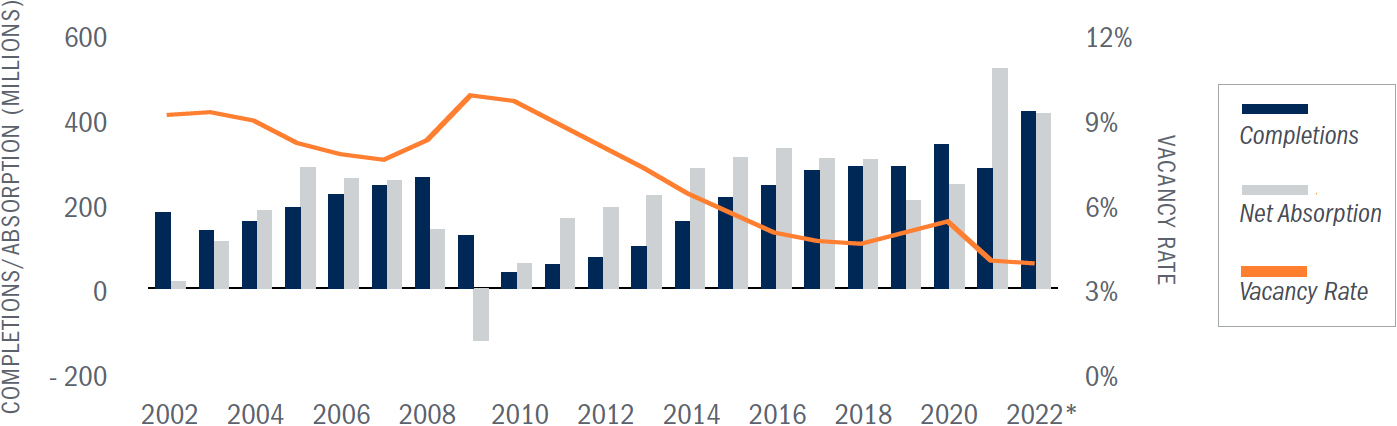

Industrial An Increasingly Essential Property Type

Supply and Demand

Source: Marcus and Millichap US Industrial Investment Forecast 2022

RESEARCH REPORT

Marcus And Millichap US Industrial Investment Forecast / 2022

Read Full ReportThe surge in demand is producing historically strong property performance metrics. A record 520 million square feet was absorbed on a net basis in 2021, as vacancy fell to a multidecade low. A robust appetite for space will push vacancy even lower this year, despite the largest construction pipeline since at least 2000. Approximately 420 million square feet of industrial space will be delivered this year, with developers focusing on larger properties. Buildings under 100,000 square feet in size comprise only a small amount of arriving space. The difficulty in developing smaller facilities closer to population centers, paired with the avid demand for such projects, will continue to apply upward pressure on rents.

QUOTES OF THE QUARTER

I think once people get through the lack of familiarity, they start to appreciate the value of the asset class (CLOs). In terms of the sheer number of people moving into retirement age, looking for current income with some confidence around capital preservation, it's a terrific asset class to generate that kind of performance.

SCOTT M. D’ORSI, CFA

Portfolio Manager in Putnam’s Fixed Income Group

E-commerce revenue growth will exceed its pre-pandemic trajectory, and we expect that e-commerce share will climb higher due to faster deployment of same-day and next-day delivery capabilities, improved online sales technologies (e.g. augmented reality, metaverse purchasing) and continued investments in segments like furniture and groceries.

JENNIFER NELSON

Head of Corporate Communications for Prologis

We expect single-family rent growth to continue to increase at a rapid pace throughout 2022

MOLLY BOESEL

Principal Economist at CoreLogic

Read more insights on the Bluerock Library.