Bluerock’s Q4 2023 Market Insights Newsletter

In This Issue…

- The Super-Rich Look to Boost Allocations to Alternative Investments

- Stifel Sees S&P 500 Delivering Little Returns into Early 2030s

- The Way Companies Borrow Money is Changing Forever

- How Private Credit Gives Banks a Run for Their Money

- Here Come the Next Waves of Industrial Demand

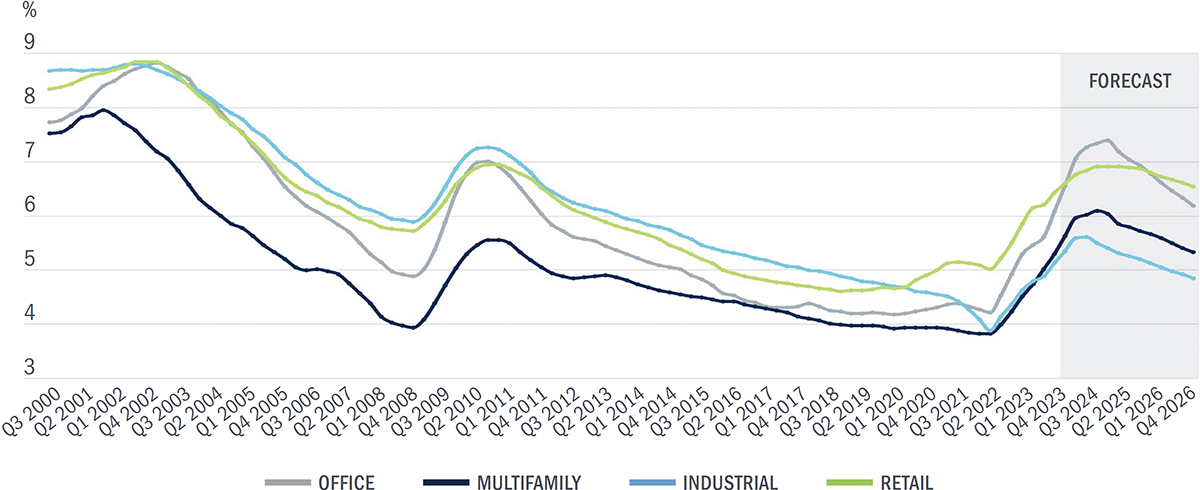

- New Data: After Peaking in 2024, CBRE Projects Cap Rates to Decline for Major Real Estate Sectors Through 2026

- New Research: CBRE 2024 Market Outlook and Cushman & Wakefield 2024 Market Outlook

FEATURED CONTENT

The Super-Rich Look to Boost Allocations to Alternative Investments

A 2022 study from the National Association of College and University Business Officers found the average endowment has nearly 40% in private investments and another 16.9% in hedge funds and 3.1% in real assets, such as gold, for a total of 60% to alternatives. This year’s UBS Global Family Office Report found that 230 single-family offices it surveyed—with an average net worth of US$2.2 billion—had 34% allocated to private investments, 7% in hedge funds, and 3% in real assets. Among the family offices, the U.S.-based organizations were the most aggressive, with 47% in private investments and 10% in hedge funds.

Source: Barrons

IN THE NEWS

Stifle Sees S&P 500 Delivering Little Returns into Early 2030s

Perhaps a bold call, but Stifel highlights that 2021-like stock performance is very unlikely to be experienced for many years to come with a forecast of stagnant inflation-adjusted returns for the next decade.

Source: Wealth Management

The Way Companies Borrow Money is Changing Forever

With traditional banks retreating from lending, BlackRock, the world’s largest asset manager, which has expanded its private-credit platform,

projects the global market will hit $3.5 trillion by 2028.

Source: Business Insider

How Private Credit Gives Banks a Run for Their Money

Move over mainstream lending, private credit is here to stay and poised to increase. Capital availability and flexibility are great for borrowers

and higher yields satisfy investors.

Source: Bloomberg.com

Here Come the Next Waves of Industrial Demand

E-commerce-generated demand continues, according to participant Alex Motiuk, director of acquisitions for Greek Real Estate Partners. Couple that with other trends emerging in the marketplace, such as the growth of onshoring and nearshoring, the increasingly globalized nature of supply chains and the rise of secondary markets in these strategies and experts are quite confident that industrial will continue to be a top asset class for commercial real estate.

Source: Globest.com

NEW DATA

After Peaking in 2024, CBRE Projects Cap Rates to Decline for Major Real Estate Sectors Through 2026

Source: CBRE 2024 Market Outlook and Cushman & Wakefield 2024 Market Outlook

NEW RESEARCH

CBRE 2024 Market Outlook and Cushman & Wakefield 2024 Market Outlook | December 2023

Commercial real estate investment activity likely will begin to pick up in the second half of 2024.

The industrial market is expected to remain healthy, with net absorption on par with 2023 levels.

The inflation rate will start the year at around 4% but fall steadily to around 2.7% by year-end.

Real estate values for most property types are unlikely to fully stabilize until mid-2024. Cap rates, excluding those for office assets, increased by roughly 150 basis points (bps) between early 2022 and late 2023 depending on market and asset type. Office cap rates rose by at least 200 bps. This implies a 20% decline in values for most property types. We think cap rates will expand by another 25 to 50 bps in 2024, with a corresponding 5% to 15% decrease in values.

Read Full ReportIndustrial and multifamily assets will likely remain most favored by investors due to relatively strong fundamentals.

QUOTES OF THE QUARTER

We’ve believed for quite some time, but especially we believe now with `{`current`}` market dynamics, that investors do have to start thinking like an endowment.

DANIEL SCANSAROLI

Head of Portfolio Strategy in UBS’ CIO Americas Office

The good news is that bonds have staged an epic rally since, and commercial property is now fairly priced vs. corporate bonds. Property pricing may well have hit bottom.

PETER ROTHEMUND

Co-Head of Strategic Research at Green Street

Read more insights on the Bluerock Library.