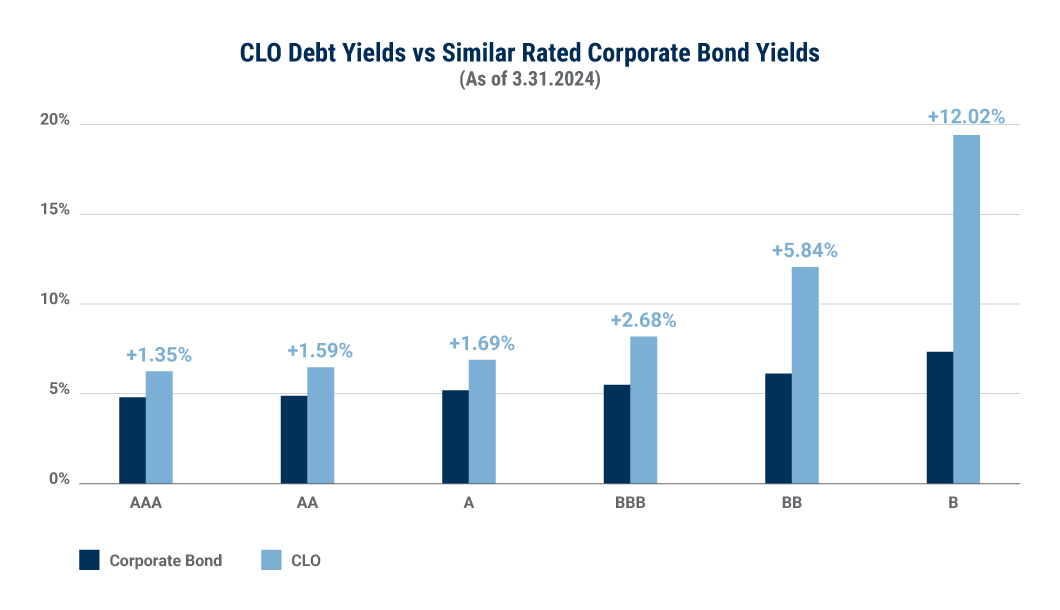

CLO Yields Attractive vs Similar Rated Corporate Debt

Collateralized loan obligation (CLO) debt yields are well above similar rated corporate debt, presenting an opportunity for savvy income investors. Fixed rate corporate debt yields currently reflect historically very low spreads vs risk free rates. CLOs, which are essentially pools of senior secured loans generate much higher yields, given the more limited availability of this investment category, and given the floating rate nature of senior secured loans. The CLO yield premiums increase as across the ratings spectrum, highlighting the significantly higher income opportunities across categories of CLOs.

Sources: Federal Reserve (ICE BofA Index), Bloomberg for CLO data (JP Morgan U.S. CLO Index)