CRE Valuations Look Compelling

Warren Buffett once said, “if you wait for the robins, spring will be over.” It turns out that Buffett’s folksy quip may hold true in the case of the recent real estate value decline. Retail capital flows into non-listed real estate peaked when values peaked in 2022 and as values declined approximately -20%, net flows also fell dramatically, close to 70%, year over year. Thus, it appears individual investors’ “herd mentality” may be self-defeating in yet another cycle, selling when they should be buying.

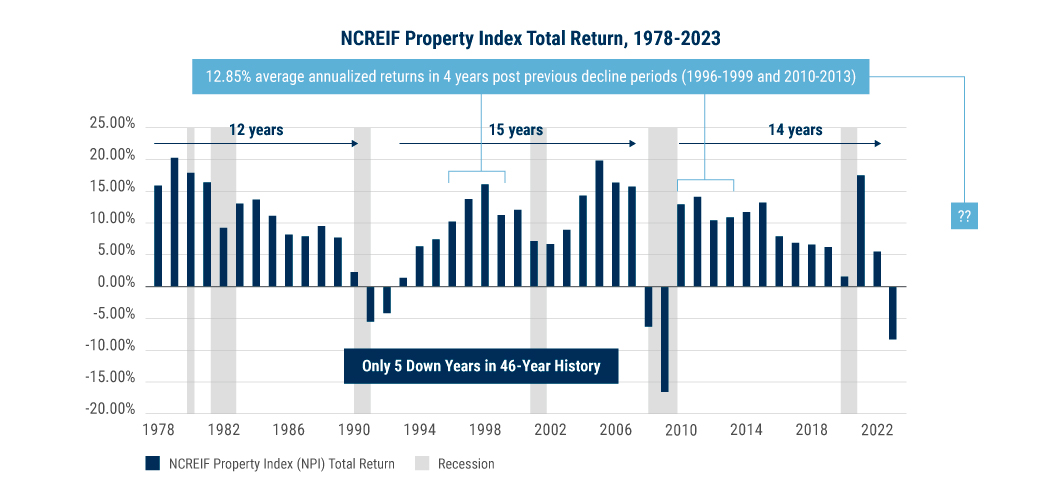

Institutional real estate has generated an 8.63% annualized return (as measured by the NCREIF Property Index (NPI) and since the index’s inception). Importantly, in the four years following the previous two major declines, the NPI has generated an average of 12.85% annualized returns. These two previous real estate declines lasted approximately 2 years, and the current decline commenced in the spring of 2022, which may signal that a turnaround is near (though admittedly it’s extremely challenging to time a market bottom in any asset class).

Source: National Council of Real Estate Investment Fiduciaries Property Index (NPI). Morningstar Direct. National Bureau of Economic Research (recessionary periods).

It sounded like Jon Gray of Blackstone is taking Buffett’s sage advice as he noted on Blackstone’s Q4 call: “While it will take time, we can see the pillars of a real estate recovery coming into place,” he said. “We are, of course, not waiting for the all-clear sign and believe the best investments are made during times of uncertainty.” Implicitly, he seems to suggest that if you wait for an all-clear sign, you probably have missed the bottom.

If the raw data and old anecdotes aren’t powerful enough, here are a few of Blackrock’s thoughts from one of their recent research reports as reported by Globest.com:

Higher construction costs and interest rates, as well as tighter lending conditions, will likely keep the number of development projects low, exacerbating the undersupply of prime property. This will only lessen any downside risk for future real estate performance.

Even though we are in a ‘higher for longer’ environment, real estate is in a stronger position today than it has been for the previous 18 months,” they wrote. “Inflation is on a downward trajectory and today we have more macro clarity, which should culminate in improved sentiment and price transparency.

Following three recent downturns, real estate has generated strong returns fueled by improving fundamentals and capital appreciation,” they wrote. “Investors today have an advantage to acquire assets at below replacement cost and can potentially take advantage of growing distress in the market.

Predicting market bottoms is tougher than forecasting the weather, but a look at the data tell us spring might be over before you know it.