Despite volatility seen in the real estate market, Bluerock still maintains high conviction in the industrial sector which is poised to maintain its durability due to:

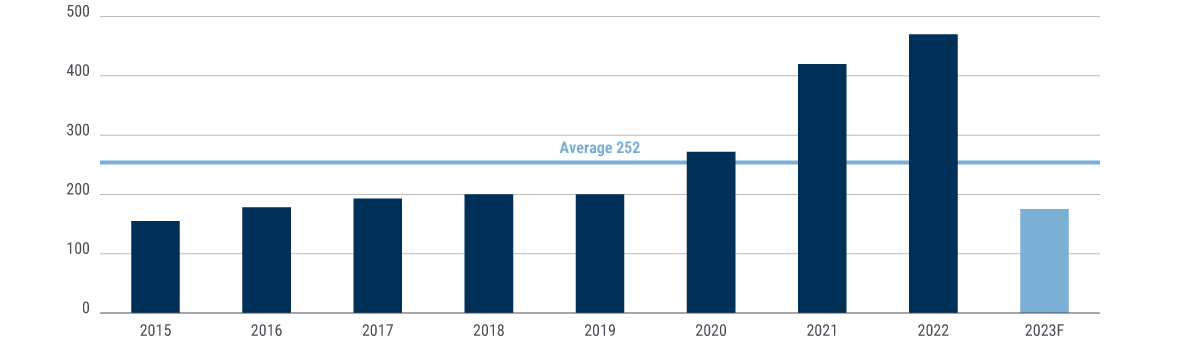

- Growth of e-commerce

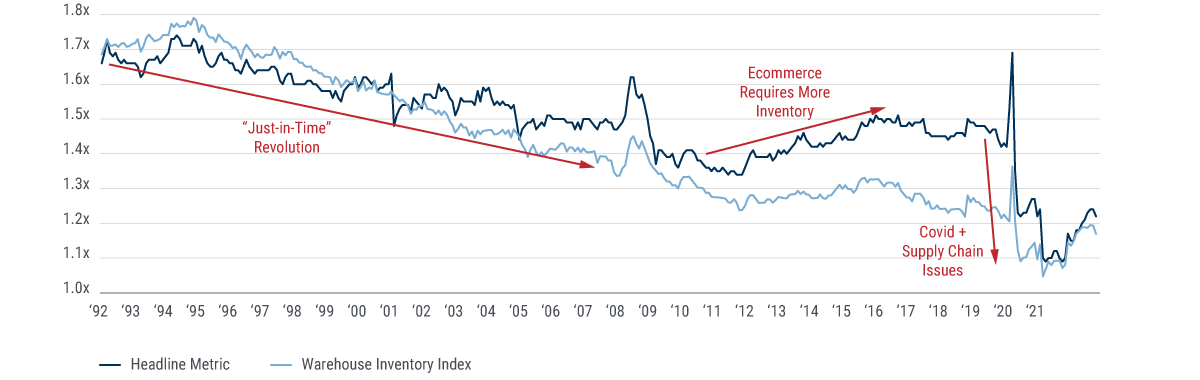

- Structural shifts in the supply chain

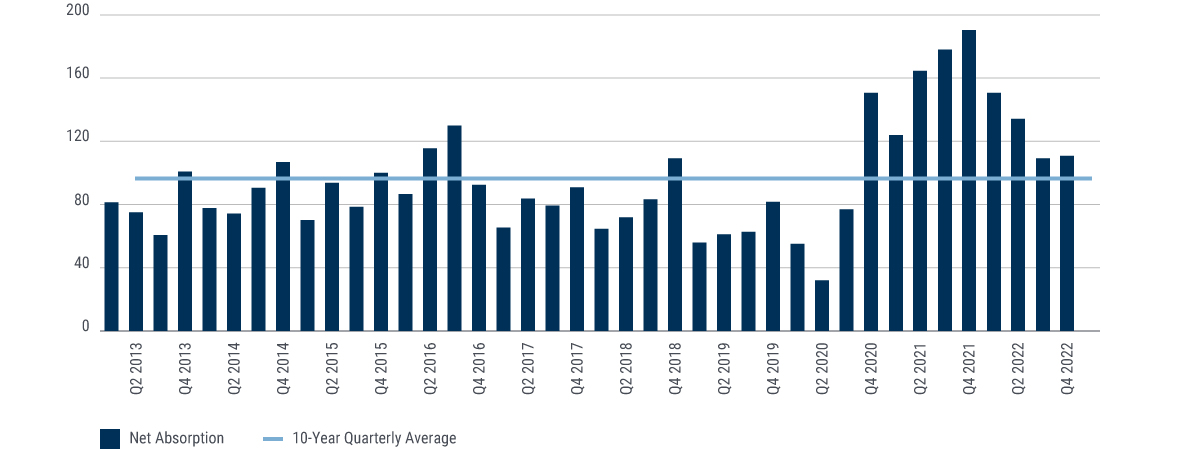

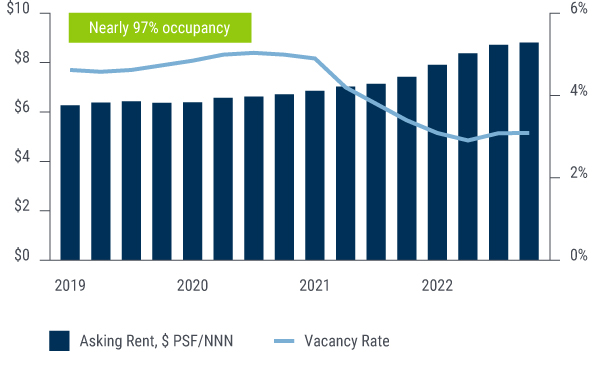

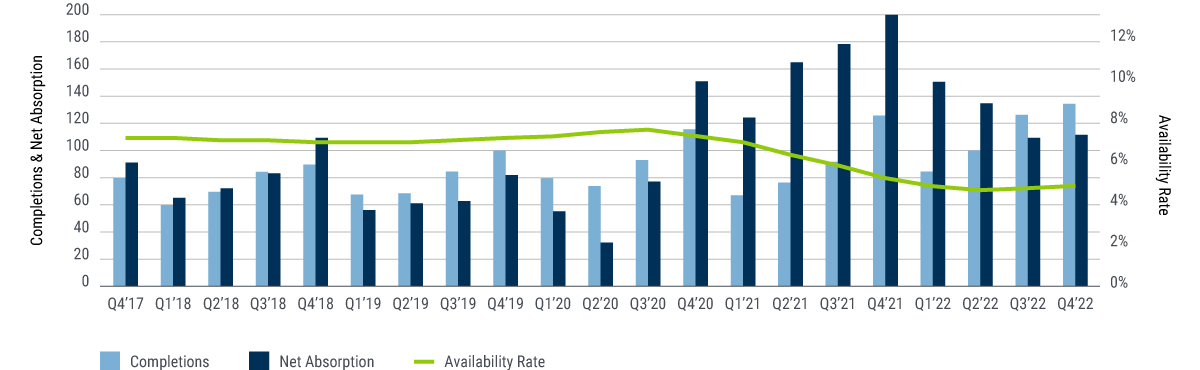

- Unprecedented demand for industrial space with limited supply.

“Industrial real estate is the engine of the global economy.”

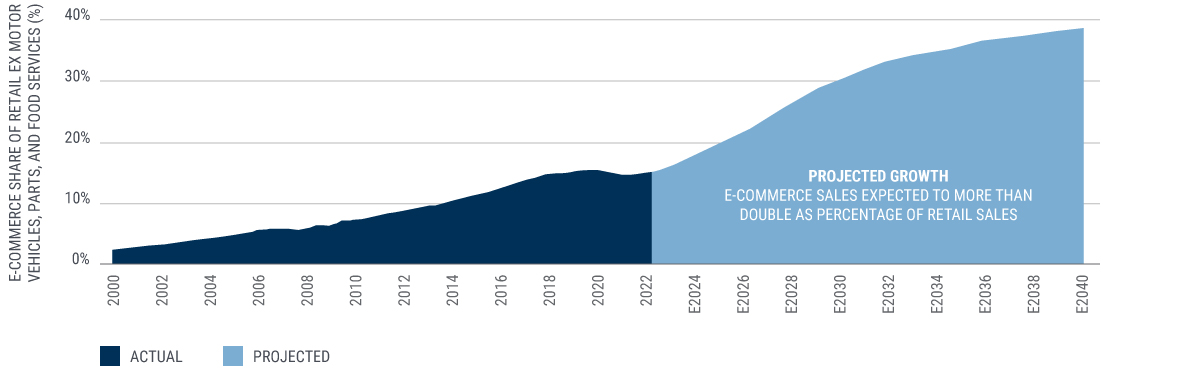

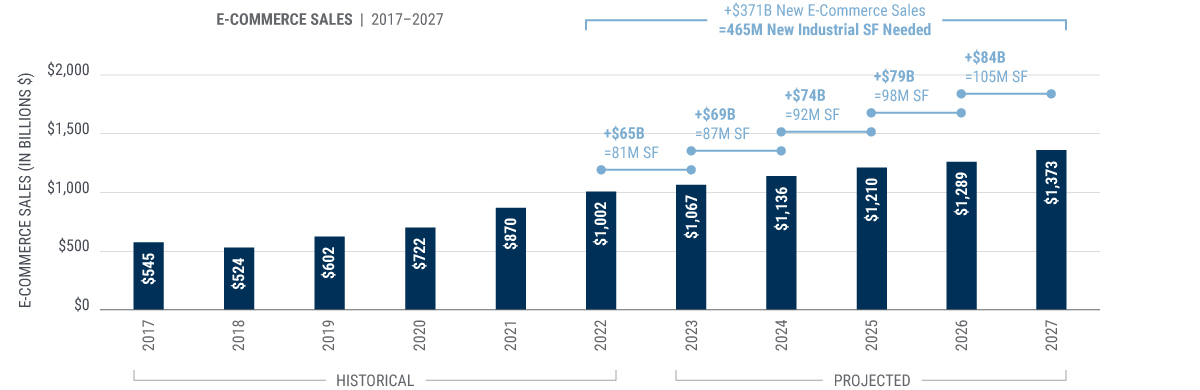

Since the beginning of the COVID-19 Pandemic, the e-commerce industry has seen record growth, standing as the crown jewel for the industrial real estate industry. This growth is expected to continue with Green Street projecting a 6.5% compounded annual growth rate through 2027. As shown in the chart below, e-commerce is expected to more than double as a percentage of sales from nearly 15% in 2022 to nearly 40% by 2040.