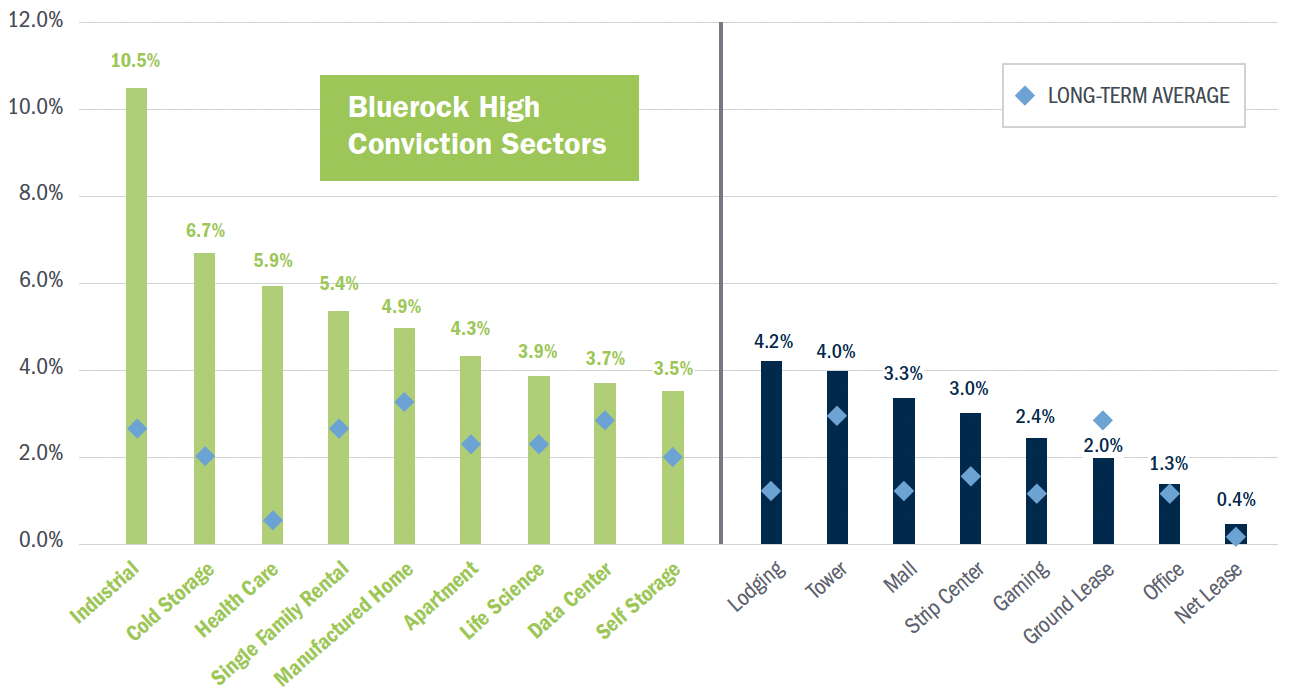

Strong Projected Growth Among Bluerock High Conviction Sectors

For institutional real estate investors, sector allocation is critical. There was a minimum of 1,150 basis points in return difference from the highest and lowest performing sectors in the NCREIF Property Index in the last five years.1 Real estate net operating income (NOI) (or simply property revenue minus property expenses) is akin to earnings in the corporate world and ultimately drives values, thus identifying sectors with the highest potential for net operating income gains is critical to outperformance.

Years ago, Bluerock identified the key sectors including industrial, residential, and life sciences, as all possess structural (vs. cyclical) demand drivers. Based on industry-leading forecasts, Bluerock’s high conviction sectors all have a high NOI growth outlook. We briefly highlight each of these sectors below.

5-YEAR ANNUALIZED NOI GROWTH RATE PROJECTION BY SECTOR2

Industrial Sector: 4x 5-Year Projected NOI Growth vs. Long-term Average

We believe the strength of the industrial market drivers will weather any possible recession, driven by e-commerce growth, extremely low vacancy rates, moderated new supply, and relatively low rent costs for logistics providers. Independent estimates call for approximately 2 billion square feet of total new industrial demand in the next five years.3 We believe e-commerce will be a major component of this and continue to gain market share and drive industrial rents higher, consistent with forecasts.

Residential Sector: Approximately 2x 5-Year Projected NOI Growth vs. Long-term Average

A housing supply shortfall combined with an extraordinary homeownership premium should drive apartment and single-family rents higher. A record low percentage of the U.S. population can afford to buy a home, per standard affordability requirements, and the ownership premium is over $1,000 per month.4 We believe that a closer equilibrium of rent vs. own will naturally take place in the market resulting in materially higher apartment and single-family rental rates.

Life Sciences Sector: Nearly 2x 5-Year Projected NOI Growth vs. Long-term Average

An aging population, growing healthcare spending, and increasing demand for novel therapies form robust drivers for life sciences real estate which we believe will perform well during recessionary periods. As demand for medical treatments and life science space grows, supply can be difficult to match. Life sciences real estate is very specialized, not likely to be converted from other spaces, and it tends to suffer from faster obsolescence. Thus, we have high conviction in the sector’s outperformance.

1 Source: Morningstar Direct

2 Source: Green Street, A Great Year Ahead for Commercial Real Estate? March 2023

3 Total industrial demand calculated using Green Street projection of e-commerce accounting for approximately 25% of total industrial demand. (Green Street U.S. Industrial Outlook January 2023).

4 Marcus and Millichap, Special Report Housing Affordability, August 2022