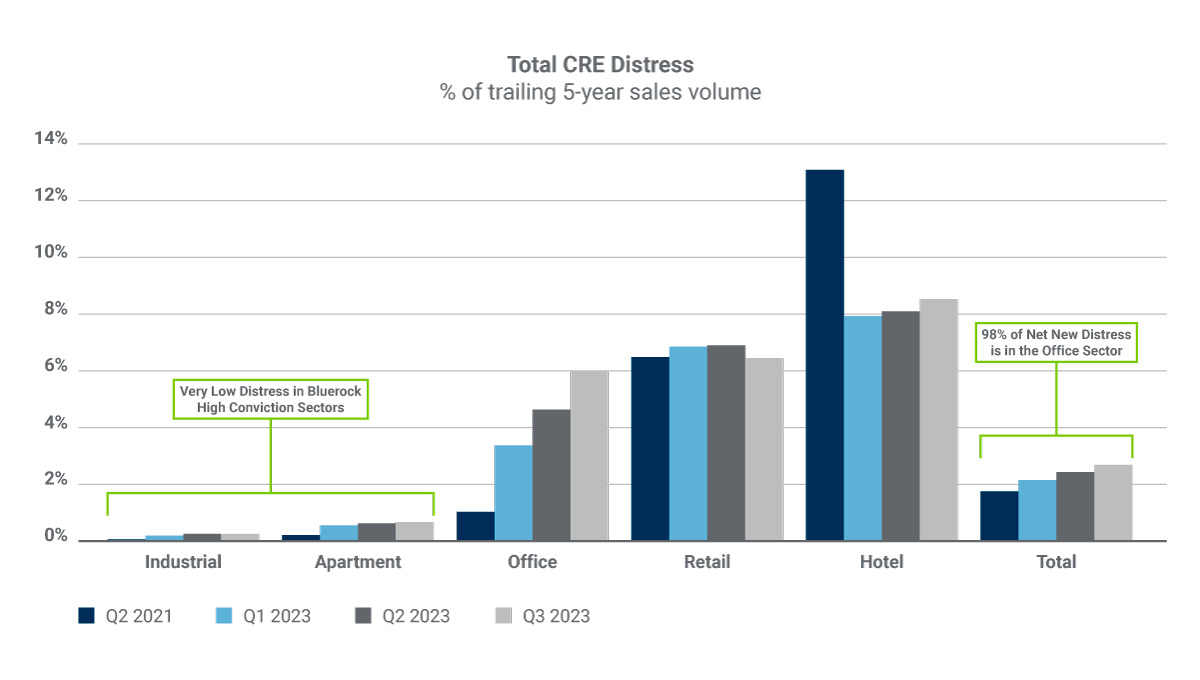

Total CRE Distress

The industrial and apartment real estate sectors, Bluerock’s highest conviction themes, have experienced little distress due to strong underlying demand fundamentals and limited new supply. The recent increase in commercial real estate loan distress has largely been confined to the office sector where 98% of the net new distress has emerged since 2021. Hotel and retail sector distress has remained notably high compared to the industrial and apartment sectors where loan distress remains less than 1% of the trailing 5-year transaction volumes. We believe the lack of distress in our favored sectors will support values more significantly, compared to other sectors as interest rates stabilize.

Source: Original chart courtesy of FS Investments, Anatomy of a CRE Correction, 2023