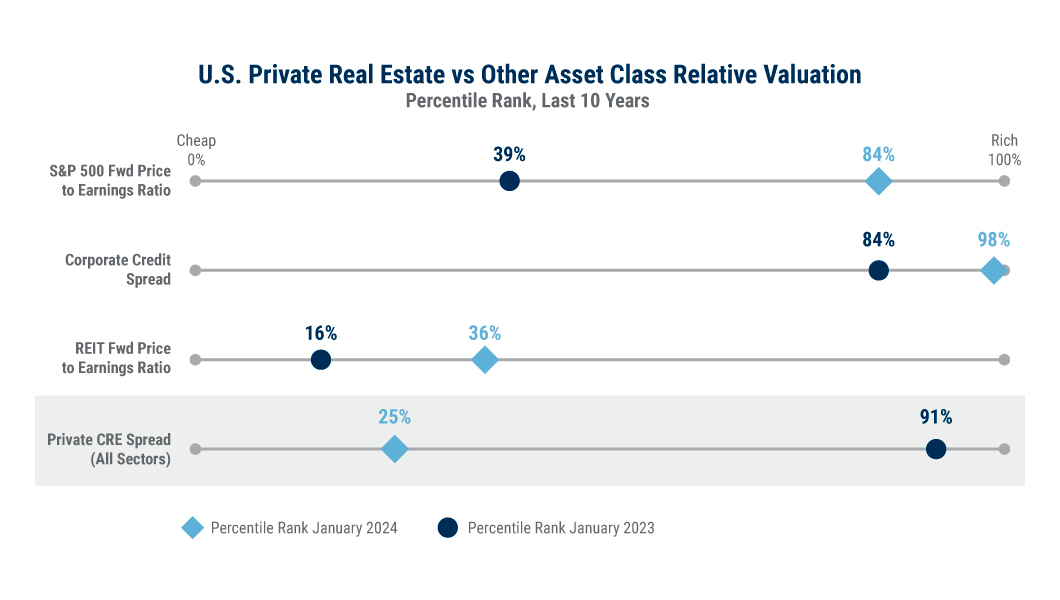

U.S. Private Real Estate vs Other Asset Class Relative Valuation

In early 2024, domestic private commercial real estate valuations look attractive compared to other domestic asset classes. Since January 2023, U.S. stocks, corporate credit, and listed REITs have gotten more expensive relative to history while private real estate has become cheaper due to its recent pricing decline. Investors can optimize their portfolios through rebalancing by allocating to relatively cheaper asset classes.

Source: Original chart courtesy of Morgan Stanley Investment Management 2024 Global Real Estate Outlook