Why Interval Funds Now?

Interval Funds: Access to Institutional Investments for Retail Investors

Given the significant structural shift in the global economy and the persistently high inflation, rapidly rising rates and slower economic growth, traditional asset classes have struggled to deliver on their historical metrics, including returns, income, or lower volatility.

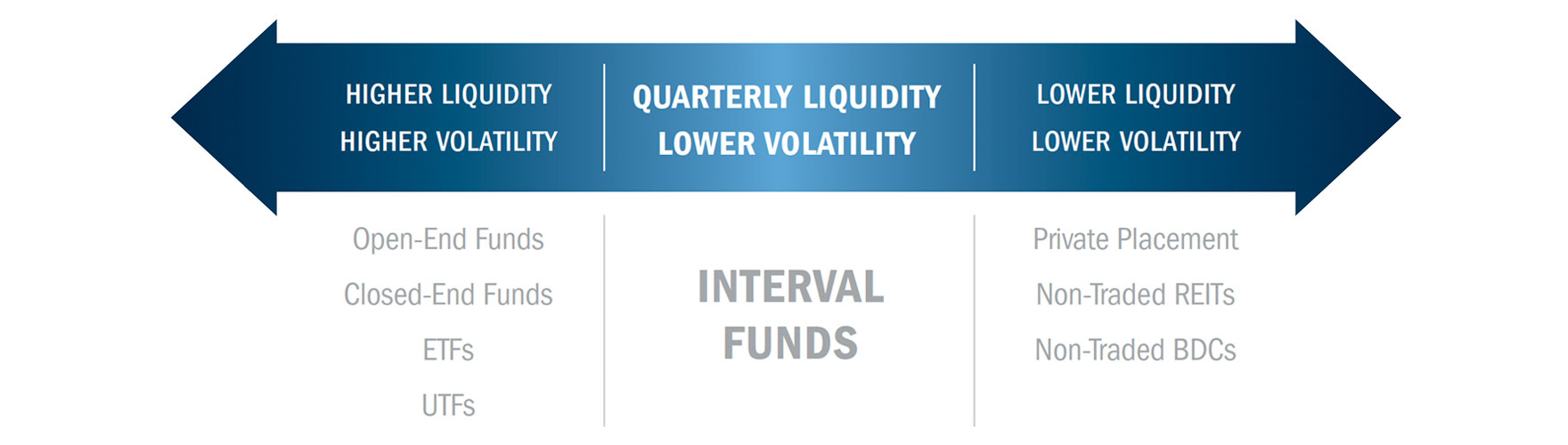

Interval funds are increasingly critical hybrid funds, balancing market desires for higher income, lower drawdowns, and lower volatility and correlation to the broader markets while still providing periodic liquidity. They provide investors access to a wide array of alternative investments that were once reserved for institutions and high net worth investors, but with lower minimum investment requirements and pricing transparency at NAV. These alternative investments can further aid in diversifying individual portfolios with the potential for higher yields compared to traditional fixed income securities, lower volatility and correlation to the broader markets, all while potentially enhancing overall long-term investment goals.

What are Interval Funds?

Interval funds are a type of closed-end fund, registered with the SEC under the Investment Company Act of 1940 (the “1940 Act”). Interval funds continuously offer new shares at a price based on the fund’s net asset value, and periodically make repurchase offers to investors, normally 5-25% of outstanding shares.

As alternative investments continuously accelerate, interval funds are becoming one of the most popular investment vehicle structures, as the structure allows an individual investor to gain access to investments with potentially attractive risk-adjusted returns or meaningful income that are typically only available to institutional investors.

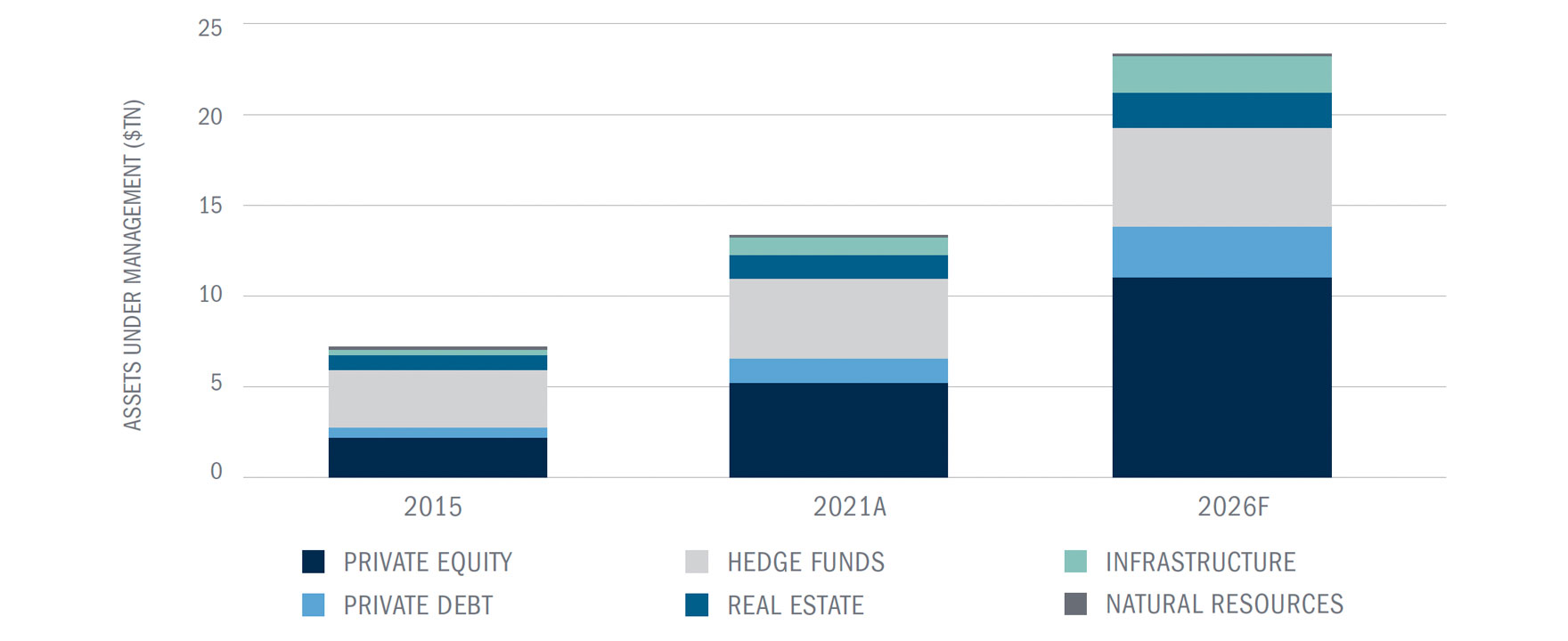

Alternatives AUM to hit $23tn in 2026

What Other Types of Investment Vehicles are There?

- An Open-End Mutual Fund is an investment vehicle that pools capital from investors, and can issue unlimited new shares, priced daily on their net asset value.

- The Listed Closed-End Fund raises capital with fixed number of shares to investors in an initial public offering (IPO). After its IPO, the fund shares trade on national securities exchanges at market prices.

- A Non-Traded Fund is a type of illiquid alternative investment that is directly offered to investors from the investment managers and is not traded on a public exchange, but non-traded funds are required to be registered with the SEC.

- One example is Non-Traded REITs, which have similarities to public REITs by allowing individual investors to invest in income producing real estate and are also subject to the same tax reporting requirements of returning at least 90% if taxable income to investors. However, they are less liquid when investors want to redeem.

- The Tender Offer Fund structure is very similar to an interval funds, a subtle but important difference is that a tender offer fund offers liquidity via periodic tender offers based on the fund’s discretion and has no liquidity requirements.

- A Private Equity Fund/LP is an alternative investment class that may be categorized as either a closed-end or open-end fund, but are not listed on a public exchange. Private equity funds and other LPs allow high-net-worth individuals and a variety of institutions to directly invest in and acquire equity ownership in privately owned companies.

Key Differences

| Listed Closed-End Fund | Open-End Mutual Fund | Non-Traded Funds | Private Equity Funds/LPs | Tender Offer Fund | Interval Fund | |

|---|---|---|---|---|---|---|

| Structure | Closed-end | Open-end | Closed-end | Closed-end | Closed-end | Closed-end |

| Offering Period | IPO | Continuous | Continuous | Continuous | Continuous | Continuous |

| Exchange-Listed | Yes | No | No | No | No | No |

| Max Illiquid Holdings | No Limit | 15% | No Limit | No Limit | No Limit | No Limit |

| Pricing Model/Valuation | Market/Daily | NAV/Daily | NAV/Periodic | NAV/Periodic | NAV/Periodic | NAV/Daily |

| Direct Redemption | No | Yes | Yes, but limited | Yes, but limited | Yes | Yes |

| Redemption Pricing | At Market | At NAV | At NAV | At NAV | NAV | At NAV |

| Redemption Frequency | Daily/As exchange allows | Daily/Through constant share repurchase | Periodic | Varies | Periodic | At state interval |

| Leverage Limit | Not to exceed 33% at GAV | Not to exceed 33% at GAV | Generally not restricted | Generally not restricted | Not to exceed 33% at GAV | Not to exceed 33% at GAV |

| Tax Reporting | 1099 | 1099 | 1099 | K-1 | 1099 | 1099 |

What are the Advantages of Interval Funds Structure?

The interval fund structure provides investors transparency and stability. Interval funds are priced daily at net asset value (NAV) for investors to purchase. Unlike closed-end public traded funds that trade on the major exchanges, and experience speculation around share prices, interval funds allow investors to buy and sell at the NAV, calculated by fund’s AUM divided by number of shares issued. There is no secondary market for interval fund shares; the funds will make offers to repurchase shares from the investors at a predetermined interval (monthly, quarterly, semi-annually and annually) at NAV.

Illiquidity may be considered a disadvantage, however there are two distinct advantages. Firstly, it may provide fund managers the opportunity to execute strategies better suited to longer holding periods, lower the frequency of transactions, and find potentially more attractive (but less liquid) opportunities in the search of long-term investment returns. Secondly, it may help mitigate investors’ emotional investing behaviors, and can encourage investors to maintain a long-term investment horizon.

Another advantage of interval funds is accessibility. Individual investors have easy access to a wider array of attractive alternatives without giving up the benefits of performance transparency, daily pricing and regular liquidity.

Why Now is the Time to Invest in Interval Funds

Traditional asset classes like equities and fixed income have become significantly correlated, generating double-digit losses and resulting in a very challenged environment for 60/40 portfolios. Interval funds typically invest in alternative asset classes that have lower correlation to broader traditional markets (including in this current environment), offering some diversification to investors’ portfolios.

Additionally, these asset classes can generate attractive income even after inflation, which investors may also take advantage of via interval funds.

In general, the interval fund structure offers greater investment flexibility to access asset classes with desirable characteristics that may be less liquid than exchange-traded securities. Especially in today’s environment, interval funds may help investors build more well-rounded portfolios that truly deliver on their long-term investment goals.

This information is educational in nature and does not constitute a financial promotion, investment advice or an inducement or incitement to participate in any product, offering or investment. Bluerock is not adopting, making a recommendation for or endorsing any investment strategy or particular security. All opinions are subject to change without notice, and you should always obtain current information and perform due diligence before participating in any investment. All investing is subject to risk, including the possible loss of principal. Bluerock cannot guarantee that the information herein is accurate, complete or timely. Past Performance does not guarantee future results.