Bluerock’s Q2 2023 Market Insights Newsletter

In This Issue…

- The Rapid Change of Commercial Real Estate

- MorningStar Panel: 60/40 Is ‘Bloodied,’ Dead

- Private Real Estate Investing Require Selectivity, Investment Managers Say

- Wholesalers Are A Shops’ Best Marketers: Advisors

- CRE is Dead, Long Live CRE

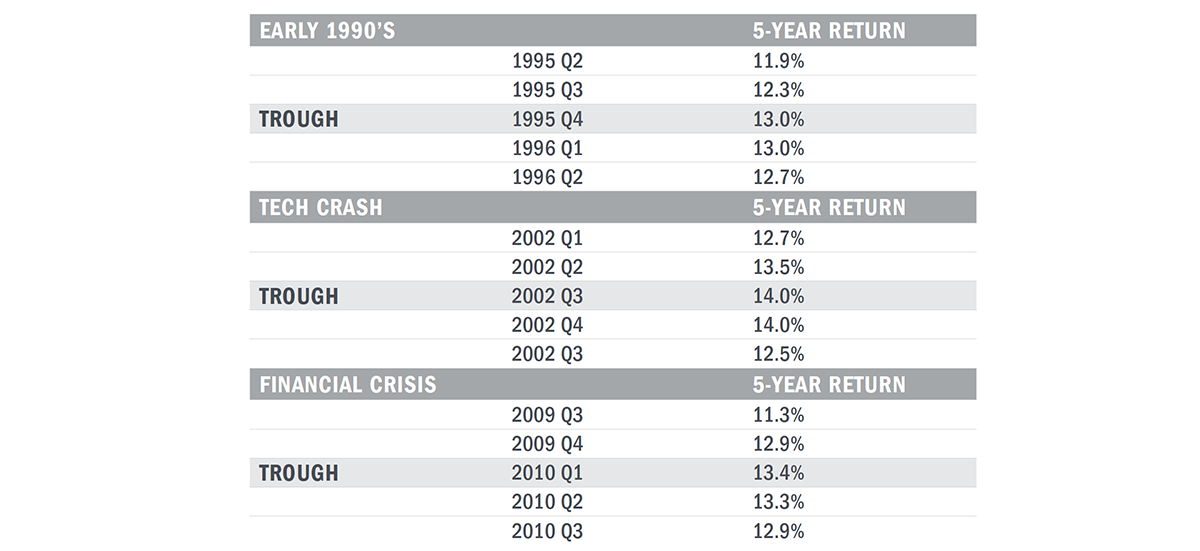

- New Data – ODCE Funds Go-Forward Five Year Annualized Total Return Following Market Troughs

- Research Report – U.S. Economic and Property Market Outlook

FEATURED CONTENT

The Rapid Change of Commercial Real Estate

A good summary of why we can’t conflate commercial real estate to office space. Focus on data and not anecdotes. Sector drivers are unique and future sector performance is likely to be very different.

Source: Bloomberg Television

IN THE NEWS

MorningStar Panel: 60/40 Is ‘Bloodied,’ Dead

A leading panel of distinguished asset managers conclude that all alternatives will be critical components of investor portfolios moving forward, that alternatives can help investor portfolios in risk and return, that retail investors may be underinvested in private alternatives, and that most asset management firms will be active in launching new products and business lines around alternatives.

Source: Wealth Management

Private Real Estate Investing Requires Selectivity, Investment Managers Say

As the institutionalization of private real estate continues, the managers that will prosper will be those that stay ahead of the curve in key demographic, societal, and geographic trends.

Source: Financial Advisor

Wholesalers Are A Shop’s Best Marketers: Advisors

Wholesalers are important in branding, but ultimately a holistic approach is necessary including digital marketing, advertising, thought leadership, and of course, investment performance.

Source: Ignites

CRE Is Dead. Long Live CRE.

An important reminder on historical perspective and the resiliency of institutional real estate. The highest returns have always been made when the market seems most dystopian.

Source: Globest

NEW DATA

ODCE Funds Go-Forward Five Year Annualized Total Return Following Market Troughs

Source: NCREIF, AEW U.S Economic and Property Market Outlook

RESEARCH REPORT

AEW

Read Full ReportPeriodic asset valuation cycles are an expected aspect of long term, particularly following significant political or economic dislocations. The Federal Reserve policy response to unacceptably high inflation is such a dislocation. Property is priced in the context of all other asset classes and valuations cannot be unaffected during a period where the cost of capital has changed significantly. Property markets will, in time, find their footing, and move forward in step with operating fundamentals (rent, occupancy, NOI) and yet to be determined pricing metrics (cap rates, discount rates). History suggests investors should expect a period of outsized positive returns following revaluations.

Subscription may be required.

QUOTES OF THE QUARTER

In our view, when you invest in alternatives you want to do it for three reasons. One, you can get growth above and beyond what you can get in the equity market. You can get income above and beyond what you can get in the public debt market. Or you can get diversification to low correlation and low beta with both equity and debt. Depending on the type of real estate, you can access all three of them.

BRIAN POLLACK

Partner and portfolio manager at Evercore Wealth Management

The general awareness of private markets `{`among retail investors and advisors`}` is all very low. Institutional investors are more exposed to private investments. What I would argue, is who needs those returns? Retail investors need them.

MICHAEL KELL

Senior Vice President, Education Strategy & Programs, iCapital

Read more insights on the Bluerock Library.