Bluerock’s Q3 2022 Market Insights Newsletter

In This Issue…

- Private Bets Shield World’s Largest Investors From Market Mayhem

- As Markets Waver, Alternatives Hit Their Stride

- Warehouses Filled to Capacity are the New Normal

- Is the 60/40 Portfolio Really Dead or Just Redefined?

- Single-Family Rental Market Shows Little Sign of Cooling

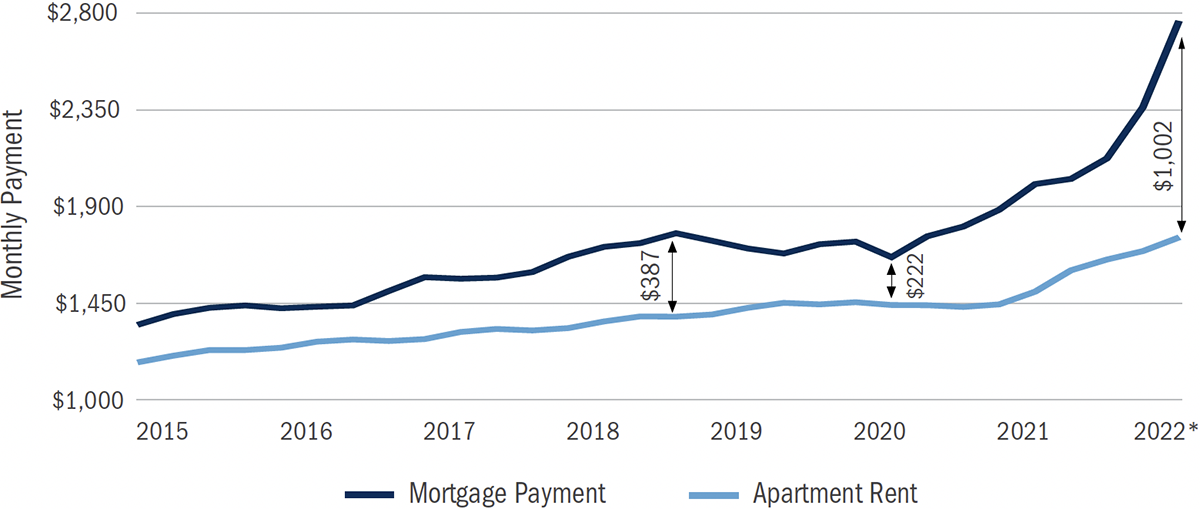

- New Data – Mortgages Substantially Outpacing Rents

- Research Report – Marcus And Millichap Special Report, Housing Affordability

FEATURED CONTENT

Private Bets Shield World’s Largest Investors from Market Mayhem

How have some of the world’s largest institutional investors shielded themselves from the recent stock and bond rout? Many of them dramatically increased their alternatives exposure after the GFC which is paying off in 2022 protecting them from much greater losses.

Source: Bloomberg

IN THE NEWS

As Markets Waver, Alternatives Hit Their Stride

According to Cerulli, the market for alternatives may have never been better given the current market backdrop of investor demand for income, inflation protection, enhanced returns, and low volatility. Cerulli also sees the new generation of semi-liquid products more palatable to advisors than previous versions.

Source: Wealth Management

Warehouses Filled To Capacity Are The New Normal

There seems to be no end in sight for the industrial market. Space is extremely difficult for tenants to secure and rents are still rapidly rising. Landlords, who are firmly in control, are also employing shorter lease durations to capitalize on rapidly rising rents.

Source: Globest

Is The 60/40 Portfolio Really Dead or Just Redefined?

The emergence of private market investment alternatives has become a staple of individual and institutional portfolios. There is no consensus on the magical allocation, but public

pension funds have a 20%-30% allocation with maybe a third of that real assets.

Source: Fund Fire (Subscription may be required)

Single-Family Rental Market Shows Little Sign of Cooling

SFR rents continued to surge into mid 2022 and the lack of supply combined with ownership unaffordability is likely to keep upward pressure on rents in the near future.

Source: Housing Wire

NEW DATA

Mortgages Substantially Outpacing Rents

Source: Marcus and Millichap Special Report, Housing Affordability August 2022

RESEARCH REPORT

Marcus And Millichap Special Report, Housing Affordability / August 2022

Read Full ReportExtreme affordability gap emphasizes multifamily appeal. Prior to the mortgage rate jump, homebuying was mostly constrained by the limited for-sale inventory. Now, more homes are being listed, but fewer are selling. Much of the housing demand is funneling to the rental market, resulting in very tight vacancy and historic rent growth. The average effective rental rate in the U.S. grew almost 17 percent year-over-year in the second quarter of 2022. Despite this leap, apartments remain a markedly less-costly option than home ownership. The affordability gap in the U.S., or the difference between an average monthly mortgage payment on a median priced home compared to an average rent obligation, was about $280 before the pandemic. At the end of 2020, it was roughly $375. Halfway through 2022, the gap is a striking $1,000. As a result of this elevation, the estimated minimum annual income to afford a house in the U.S. eclipsed $120,000 in June, a threshold that 73-plus percent of households cannot afford. By comparison, that average was close to 50 percent between 2010 and 2019.

Subscription may be required.

QUOTES OF THE QUARTER

Industrial landlords hold all the cards in an environment of such space scarcity, and most adjustments made to new lease terms are to keep up with the momentum of the market.

LISA DeNIGHT

National Industrial Research Director, Newmark

We’re pretty confident that we won’t see any drastic dip in `{`SFR`}` rental prices over the rest of 2022, There’s an imbalance between supply and demand, so landlords, including institutional investors, they still have the power to determine the prices right now.

BRANDON LWOWSKI

Director of Research at HouseCanary

Clearly, there is a market opportunity for products that offer something between the long-term lockups of institutionally oriented structures and the daily liquidity of most stock and bond funds.

DANIIL SHAPIRO

Cerulli Director

Read more insights on the Bluerock Library.